Grandview Bank

Founded on July 3,1890, Grandview Bank is the fourth oldest state-charted bank in Texas. It has banking offices are located in Grandview, Cleburne, Alvarado and Weatherford.

The FWBP asked Robert Stewart, CEO, Grandview Bank to write about his experience with the Paycheck Protection Program. Here’s his report.

The PPP (Paycheck Protection Program) is an example of a well-intended platform that has a kick at the end. Think of a fine dinner featuring a succulent steak at Del Frisco’s or Bonnell’s and the meal is exceptional, with the exception of the very last bite, which is bitter and sour.

Such is the case with PPP, which begins as a loan backed by the Small Business Administration (SBA) that becomes a grant once the borrower proves the funds were used for their intended business purposes.

Grandview Bank has been honored to assist 220 customers in securing PPP loans that totaled more than $12.5 million, at an average of $56,000 each. I applaud the Federal Government and the SBA for offering this much-needed financial backstop for our nation’s small businesses.

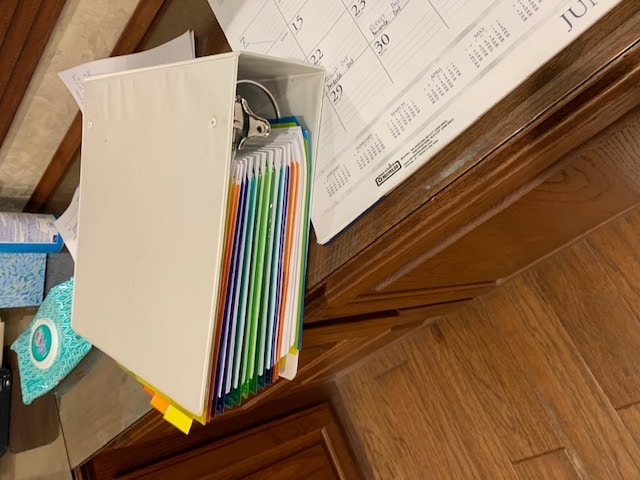

Just recently, one of our customers brought his paperwork to transition his loan into a grant – in a five-inch-thick notebook. There’s that bitter last bite.

He said that compiling all the paperwork and the supporting data required 40 hours of administrative time. Certainly, this heavy amount of burdensome work is not what anyone with the Treasury Department intended.

Next will be the amount of time that members of my team will invest to ensure that every minute point is verified. A bank our size does not have the resources when required to repeat this process for 219 more customers.

For that matters, banks of much larger size that are required to document five or ten times our number of loans will be hard challenged in performing their due diligence.

We are in business to serve our customers however possible, and sometimes that means just breaking even or sustaining a minor loss. However, this higher level of required resources is likely to require additional diligence and resources.

When this matter was first brought to the attention of the SBA, the Treasury Department responded by reducing the required documentation in certain situations. That gesture represented a good start, but the reduction in data required still demands extensive detail that requires an inordinate amount of work.

Again, I applaud the Federal Government for intending to help. I also recognize that a certain amount of data verification is required to eliminate or severely reduce the potential for fraud.

However, the form appears to be so intimidating that I fear that borrowers are going to ask their bankers to complete the forms for them – an unreasonable request since the banks are the simple gateways to the loans, with very little revenue generated.

In my opinion, particularly with smaller PPP loans, the SBA should provide blanket forgiveness based on simple borrower certifications that the funds were used for intended purposes, in compliance with the program guidelines. Any misuse of funds should carry powerful penalties.

The Paycheck Protection Plan is filled with good intentions and unintended consequences.

Robert Stewart is CEO of Grandview Bank.