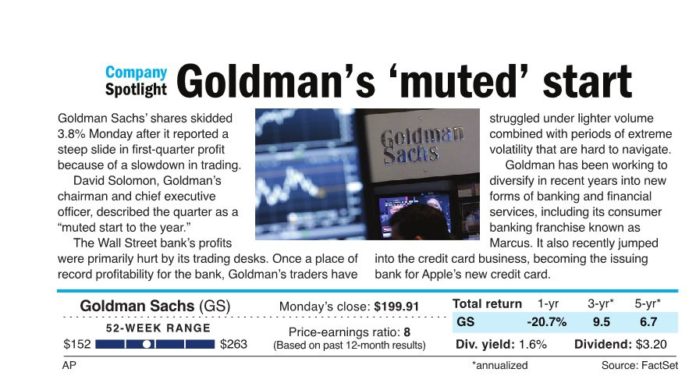

Goldman Sachs’ shares skidded

3.8% Monday after it reported a

steep slide in first-quarter profit

because of a slowdown in trading.

David Solomon, Goldman’s

chairman and chief executive

officer, described the quarter as a

“muted start to the year.”

The Wall Street bank’s profits

were primarily hurt by its trading desks. Once a place of

record profitability for the bank, Goldman’s traders have

struggled under lighter volume

combined with periods of extreme

volatility that are hard to navigate.

Goldman has been working to

diversify in recent years into new

forms of banking and financial

services, including its consumer

banking franchise known as

Marcus. It also recently jumped

into the credit card business, becoming the issuing

bank for Apple’s new credit card.