A robust economy driven by employment and population growth is driving a vibrant real estate market in Fort Worth with only a few hiccups, particularly in the shifting retail sector, leading experts said Jan. 19 at the 2017 Commercial Real Estate Forecast.

Experts in the retail, residential, industrial and office markets reported upticks in overall activity with some challenges such as a large swatch of office vacancies in downtown Fort Worth and a retail market struggling against the growing e-commerce share of the market and the untraditional consuming habits of millennials, who make up a large and growing segment of the population.

While there are plenty of new retail developments on the horizon that such as Presido in North Fort Worth, a Tanger Outlet Mall near Texas Motor Speedway and CASSCO/Simon Clear Fork development along Chisholm Trail Parkway, retail shopping centers of the future will not resemble those of the past, said Steve Coslik, chairman of The Woodmont Company.

“Restaurants are going to be anchor of retail developments in the future,” he said.

Department stores such as Kohl’s, Sears and Dilliard’s have been especially hard-hit by the shifting shopping habits of consumers, with luxury retailers like Neiman Marcus struggling the most, he said. Neiman’s, he said, is weighted down by “sustainable debt” of about $5 billion.

Part of the blame is online shopping but Coslik said only 8.7 percent of retail sales worldwide in 2016 took place online. About 64 percent of American shoppers prefer to touch and buy from a brick-and-mortar store.

The problem is that millennials, don’t want to buy a new outfit at Neiman Marcus or Dilliard’s, Coslik said. They want to shop at edgier, fashion-forward stores such as H&M that specialize in low-cost, trendy apparel that can be worn about tossed away a month later.

Despite the gloomy outlook that will likely result in the eventual razing of Ridgmar Mall and its replacement with apartments and office development in the future, the prospect for the growth of grocery stores looks bright with the arrival of the Germany-based chain of LIDL in the Dallas-Fort Worth market, the most competitive in the United States as well as the anticipated opening of an H-E-B store in the Tarrant area, a Whole Foods Market in the Waterside development and a Tom Thumb store in the Left Bank/ Seventh Street area.

The strongest parts of the Fort Worth area real estate market are the multi-family and industrial segments.

With Dallas-Fort Worth leading the country in job growth with 114,000 jobs added through November 2016, demand for apartments was strong, particularly since the inventory of affordable homes was tight, according to Drew Kile, a senior director of Institutional Property Advisors at Marcus & Millichap Real Estate Investment Services.

The DFW market added 22,100 new apartments in 2016, although only about 4,000 were in the Fort Worth area. The DFW area led the nation with the absorption of 27,000 units, Kile said.

Demand pushed occupancy to 96.1 percent in Fort Worth with annual rent climbing by 8 percent from 2015, he said. The trend is expected to continue in 2017 with 28,000 new units planned in the DFW area, including 4,000 in Fort Worth that will this year and into 2018, Kile said.

The DFW area multifamily market is second to Atlanta due to high number of 20-34-year-olds that account for the majority market. Growth of this age group is expected to bring 100,600 new renters into the DFW multi-family market by 2021, Kile said.

Overall in 2016, the vacancy rate was 3.5 percent, the average rent was $1.296, 131,000 transactions were completed for a volume of $159 billion.

Going forward, Kile predicts announcements of three new Southside area developments, more growth of suburban garden-style apartments, interest rates for multi-family development rising modestly at less than 25 basis points and the first apartment development with a drone landing pad for Amazon delivers will open in 2017.

The industrial market also continues on a strong trajectory as a foreign investment dollars in in the in market and deals such as Facebook’s $1 billion data center in the Alliance area. Facebook purchased 110 acres for the facility in 2015 and has increased the footprint to 150 acres and two additional buildings, said Tony Crème, , senior vice president of Hillwood Properties.

Alliance remained a focal point for growth in North Texas and across the state in 2016, generating $10.9 billion in economic development and 67,000 jobs, according to a Texas Comptrollers report. Along with submarkets such as Centerport near Dallas-Fort Worth International Airport and Great Southwest in East Tarrant County, the Tarrant County industrial market grew to 297 million square feet to claim 35 percent of the total DFW market, Crème said.

Under construction is 9.5 million square feet for 39 percent of the DFW market and the vacancy rate of 5.9 percent is below the DFW rate of 6.1 percent, he said.

Looking ahead, Crème said he expects investors to see Fort Worth as a major market and not a secondary market; industrial investment will remain strong with increased flow or foreign money; and e-commence will continue to drive user and shipper demand.

Meanwhile, the office market remains a mixed bag as the withdraw of energy company offices from downtown stabilized in 2016 but the result was a vacancy rate of 14.7 percent and 200,000 square feet of sub-lease space available, including multiple full-floor options, according to Todd Burnette, managing director of JLL’s Fort Worth office.

Activity was down 40 percent in 2016, Burnette said.

“It’s a tenant’s market,” he said.

But on the bright side, sublease is declining, Class A market is stabilizing and the vacancy rate is lower than 2014, he said. Meanwhile, the suburban office market is expanding with new developments, rent growth and a positive outlook for population and job growth this year, he said.

The year ahead should keep downtown rents flat but activity will pick up and sublease space will peak, he said.

Brandon Gengelbach, gave his first predictions as the new executive vice president of economic development of the Fort Worth Chamber of Commerce.

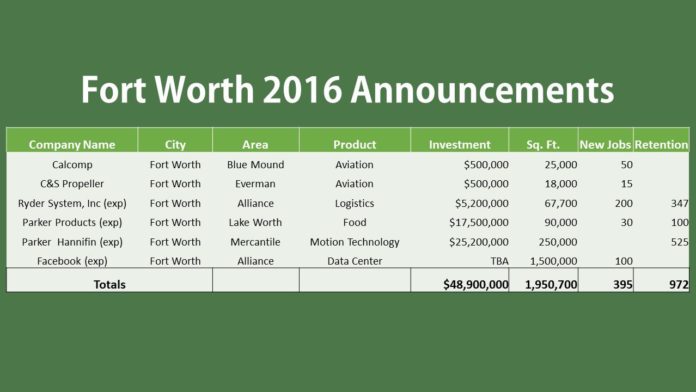

Pointing to “broad-based and steady growth,” during 2016, Gengelbach said Fort Worth has many strengths, including 14 percent employment growth that added 134,000 new jobs, a strong education system, a development-friendly environment that has added value and transformative change and a deep commitment to private-public partnerships and transportation and infrastructure improvements.

Yet, challenges remain, including building better awareness of Fort Worth and its assets, a targeted strategy for downtown and increasing the budget for economic development incentives.

‘Because we are growing, we need to have the right economic development strategy in place,” he said, noting that the chamber and the city of Fort Worth are both in the process of developing new strategic plans.