The housing market in Fort Worth during February recorded mixed results with median sales prices slightly higher than in January while inventory tightened and the number of closed home sales dropped 10.1 percent compared to February 2022.

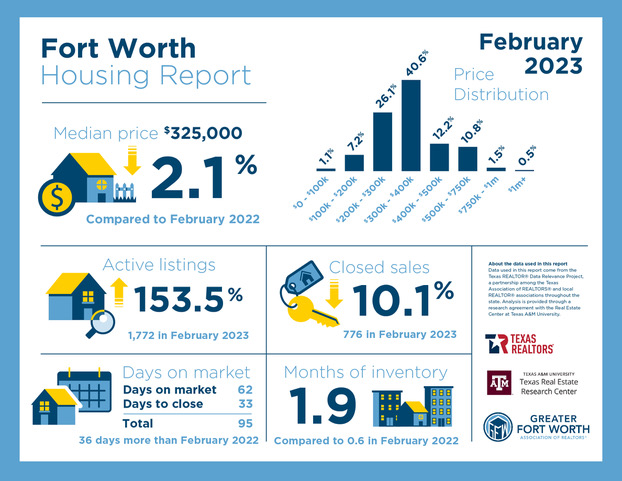

The median sales price of a home in Fort Worth in February was $325,000, up slightly from $320,000 in January, but down 2.1 percent compared to the February 2022 median sales price of $333,099.

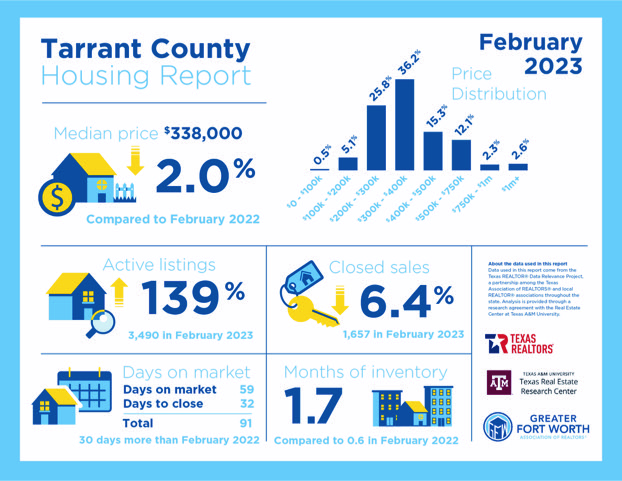

Across Tarrant County, the median sales price in February was $338,000, down 2 percent from February 2022. Median sales prices in Parker County dropped 4.7 percent to $410,000 in February compared to the previous year.

Johnson County’s median sales price rose to $364,500, bucking the pattern of decline in the other areas with an increase of 14.6 percent increase year-over-year.

Lower sales prices should be a welcome sign for prospective homebuyers who were shut out of the home-buying process by prolonged high sales prices and bidding wars.

But the shift toward a buyer’s market comes with a spike in interest rates that continues to sideline many buyers.

“People pay closer attention to the rates now,” Bart Calahan, president of the Greater Fort Worth Association of Realtors, said in a statement.

“They notice every fluctuation now that we’re getting closer to 7 percent again,” he stated. “February was hindered by those climbing rates and bad weather.

“But the next several months will bring better indicators on how the year will play out,” he stated.

Inventory in February slid to 1.9 percent in Fort Worth, down from 2.1 months in January. Across Tarrant County, inventory fell to 1.7 percent down from 1.9 months the previous month.

Despite the decline, inventory was still well above year-ago levels that were less than one month.

Inventory remained higher in Johnson and Parker counties, which recorded 3 months and 3.6 months respectively in February. Those levels were slightly lower than in January but well above February 2022 levels that hovered at less than 1.5.

The Texas Real Estate Research Center at Texas A&M University considers 6.5 months of inventory a balanced real estate market, indicating that current levels are still extremely low.

Active listings in Fort Worth during February fell to 1,772 in Fort Worth, down from 1,972 in January. However, it was a 153 percent increase compared to active listings a year ago.

Last month, 776 houses were sold, down 10.1 percent from February 2022.

Across Tarrant County, 1,657 houses were sold last month, a drop of 6.4 percent, compared to a year ago. Active listings of 3,490 homes were recorded across the county last month, up 139 percent compared to a year ago.

Parker County also recorded a decline in sales, with 196 homes sold during February, down 11.3 percent from a year ago. There were 949 homes listed for sales last month, an increase of 177.5 percent compared to February 2022.

Besides an increase in median sales prices, Johnson County also experienced a spike in sales during February, with 219 homes sold, an increase of 23.7 over February 2022.

Homes in Fort Worth and across the other areas stayed on the market at least 30 days longer in February than they did a year ago.

“Rates are significantly higher than the previous year, but they are still considered historically low,” said Nadia Evangelou, senior economist and director of real estate research at for the National Association of Realtors. “Inventory remains tight, but there are typically about 60 percent more new listings during March and August than the rest of the year.”

Interest rates on a 30-year, fixed rate mortgage had been fluctuating the past few weeks but fell to 6.42 percent as of March 23, down from 6.6 percent a week ago, according to Freddie Mac. A year ago, rates for a 30-year, fixed-rate mortgage averaged 4.42 percent.

“On the homebuyer front, the news is more positive with improved purchase demand and stabilizing home prices,” Sam Khater, chief economist for Freddie Mac, said in a statement. “If mortgage rates continue to slide over the next few weeks, look for a continued rebound during the first weeks of he spring home-buying season.”