Trimming the branches

There is a revolution taking place in branch banking. Institutions are decommissioning branches at a record pace, while still strategically opening new locations to better serve customers.

That’s the finding of a new study from JLL.

In the commercial real estate firm’s Branch Banking 2020 report, the total number of branches in the New York metro area dropped 6.8% from 2018 to 2019, compared to Chicago and Los Angeles which saw drops of 2.7% and 2.1%, respectively, during the same time period.

Only seven markets, including Austin and Kansas City, recorded more openings than closings in 2019.

According to the report, Dallas-Fort Worth area reached a high of 1,738 bank branches in 2013. That has now fallen to 1,615 in 2019, with 44 branches closing in 2019.

While the ideal branch is now smaller and more digitally focused, this industry shift is taking place incrementally across all markets.

The focus on digital-only customer experience continues to gain steam, but it is not complete – at least not yet, according to the study.

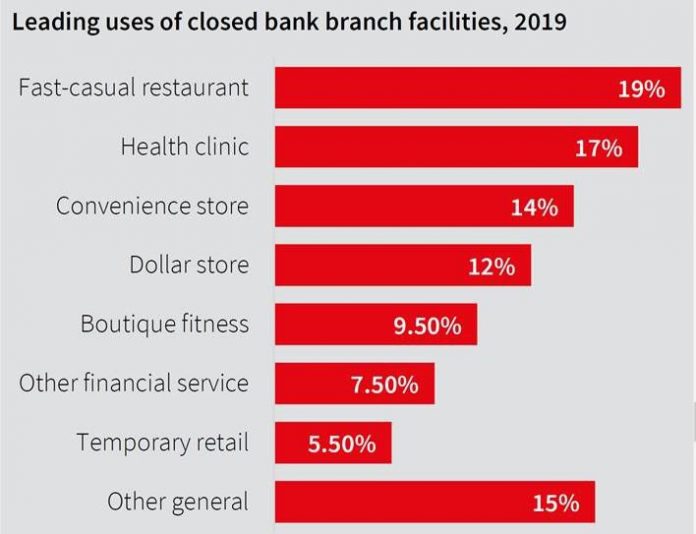

And what is happening to those closed branches?

Well, you may be eating lunch in one.

According to JLL, 19% are being utilized as fast-casual restaurants, while 17% become health care clinics.