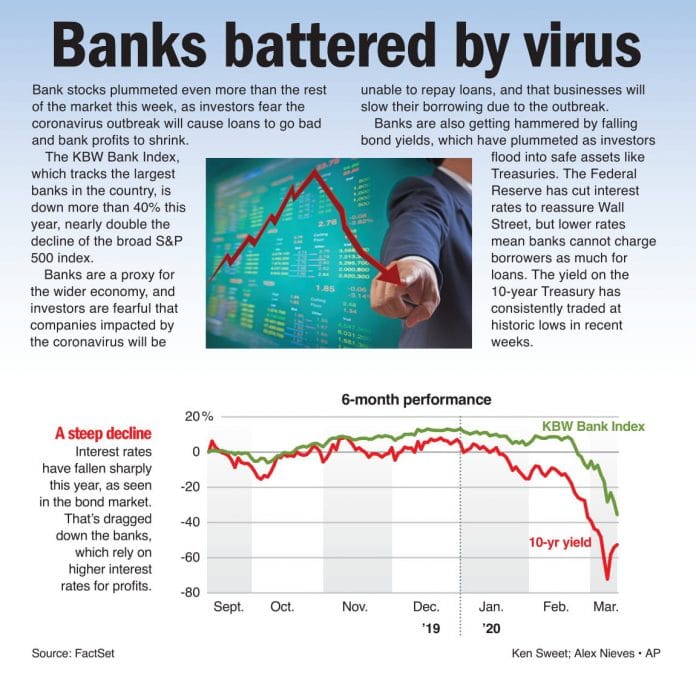

Bank stocks plummeted even more than the rest of the market this week, as investors fear the coronavirus outbreak will cause loans to go bad and bank profits to shrink. The KBW Bank Index, which tracks the largest banks in the country, is down more than 40% this year, nearly double the decline of the broad S&P 500 index. Banks are a proxy for the wider economy, and investors are fearful that companies impacted by the coronavirus will be unable to repay loans, and that businesses will slow their borrowing due to the outbreak. Banks are also getting hammered by falling bond yields, which have plummeted as investors flood into safe assets like Treasuries. The Federal Reserve has cut interest rates to reassure Wall Street, but lower rates mean banks cannot charge borrowers as much for loans. The yield on the 10-year Treasury has consistently traded at historic lows in recent weeks.