Banks got a big boost last week from the Federal Reserve, which gave the go-ahead to the nation’s biggest banks to buy back more of their stock and pay out more to investors. The Fed announced the results of this year’s so-called stress tests last week, which showed that JPMorgan, Wells Fargo and the other 16 banks tested have enough capital to withstand a sharp recession without collapsing. To pass the Fed’s tests, each of the banks had to submit its plans to return profits to shareholders via higher

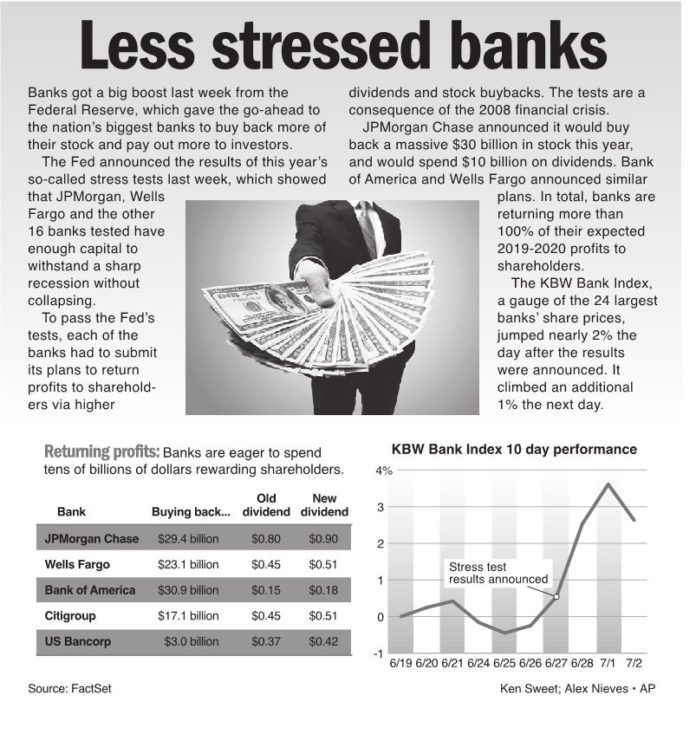

dividends and stock buybacks. The tests are a consequence of the 2008 financial crisis. JPMorgan Chase announced it would buy back a massive $30 billion in stock this year, and would spend $10 billion on dividends. Bank of America and Wells Fargo announced similar plans. In total, banks are returning more than 100% of their expected 2019-2020 profits to shareholders. The KBW Bank Index, a gauge of the 24 largest banks’ share prices, jumped nearly 2% the day after the results were announced. It climbed an additional 1% the next day.