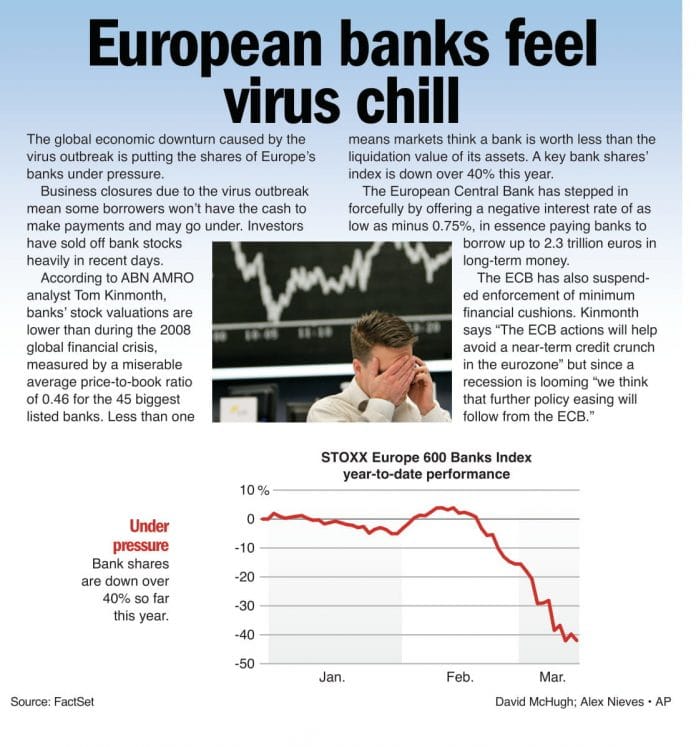

The global economic downturn caused by the virus outbreak is putting the shares of Europe’s banks under pressure. Business closures due to the virus outbreak mean some borrowers won’t have the cash to make payments and may go under. Investors have sold off bank stocks heavily in recent days. According to ABN AMRO analyst Tom Kinmonth, banks’ stock valuations are lower than during the 2008 global financial crisis, measured by a miserable average price-to-book ratio of 0.46 for the 45 biggest listed banks. Less than one means markets think a bank is worth less than the liquidation value of its assets. A key bank shares’ index is down over 40% this year.

The European Central Bank has stepped in forcefully by offering a negative interest rate of as low as minus 0.75%, in essence paying banks to borrow up to 2.3 trillion euros in long-term money. The ECB has also suspended enforcement of minimum financial cushions. Kinmonth says “The ECB actions will help avoid a near-term credit crunch in the eurozone” but since a recession is looming “we think that further policy easing will follow from the ECB.”