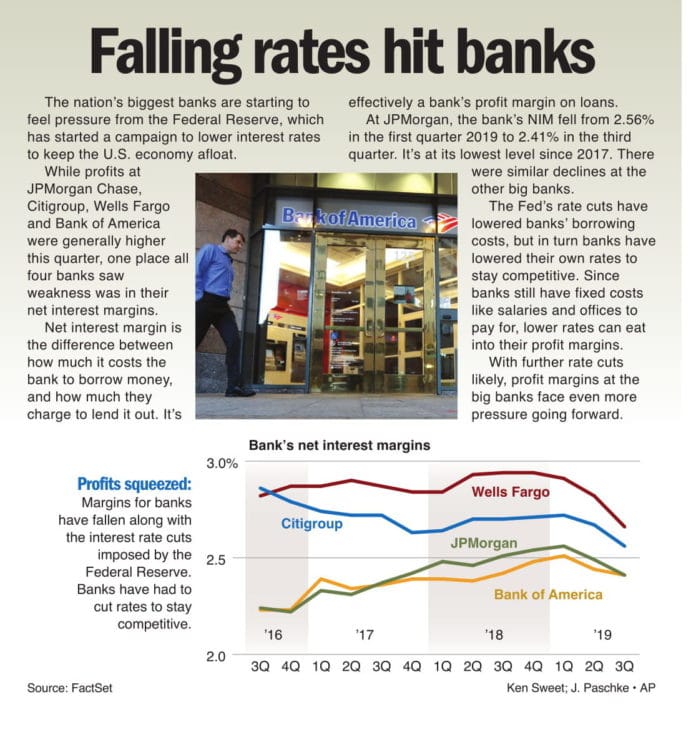

The nation’s biggest banks are starting to feel pressure from the Federal Reserve, which has started a campaign to lower interest rates to keep the U.S. economy afloat. While profits at JPMorgan Chase, Citigroup, Wells Fargo and Bank of America were generally higher this quarter, one place all four banks saw weakness was in their net interest margins. Net interest margin is the difference between how much it costs the bank to borrow money, and how much they charge to lend it out. It’s

effectively a bank’s profit margin on loans. At JPMorgan, the bank’s NIM fell from 2.56% in the first quarter 2019 to 2.41% in the third quarter. It’s at its lowest level since 2017. There were similar declines at the other big banks. The Fed’s rate cuts have lowered banks’ borrowing costs, but in turn banks have lowered their own rates to stay competitive. Since banks still have fixed costs like salaries and offices to pay for, lower rates can eat into their profit margins. With further rate cuts likely, profit margins at the big banks face even more pressure going forward.