A fund of Fort Worth and San Francisco-based TPG with rock star connections has invested in Acorns, a micro-investing app that has more than 2.7 million investment accounts.

The Rise Fund, TPG’s global investment fund that looks at achieving measurable social and environmental outcomes as well as financial returns, made an undisclosed investment in the digital wealth management firm based in Irvine, California.

The transaction marks The Rise Fund’s first investment in a fintech (financial technology) company. Acorns says its mission is to “look after the financial best interests of the up-and-coming.”

The 150-person company wants to offer financial management services to the 182 million Americans making less than $100,000 a year, and the 69 percent who don’t have $1,000 in emergency savings, according to a news release.

“We’re very excited to partner with Acorns. Financial services is one of the seven key sectors we are targeting for The Rise Fund,” said John Flynn, principal at TPG. “Acorns is exactly the type of company we’re looking to support. They have achieved extraordinary business success characterized by rapid growth while also helping to make it easy, efficient and transparent for Americans to generate savings and build their futures.”

Late last year, Acorns acquired Vault, a Portland-based tech company, which lets customers automatically invest part of their paycheck into a retirement fund.

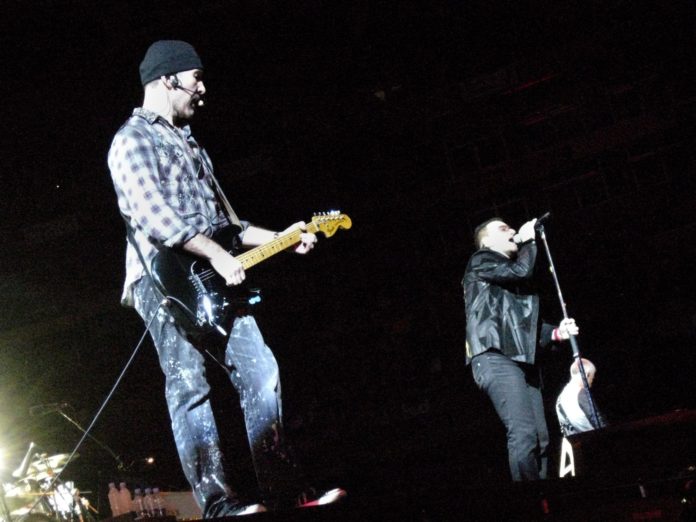

The Rise Fund is managed by TPG Growth, the global growth equity and middle market buyout platform of alternative asset firm TPG. TPG Growth Founder and Managing Partner Bill McGlashan, U2 lead singer Bono and Jeff Skoll, a global entrepreneur, film producer, and impact investor, co-founded The Rise Fund.