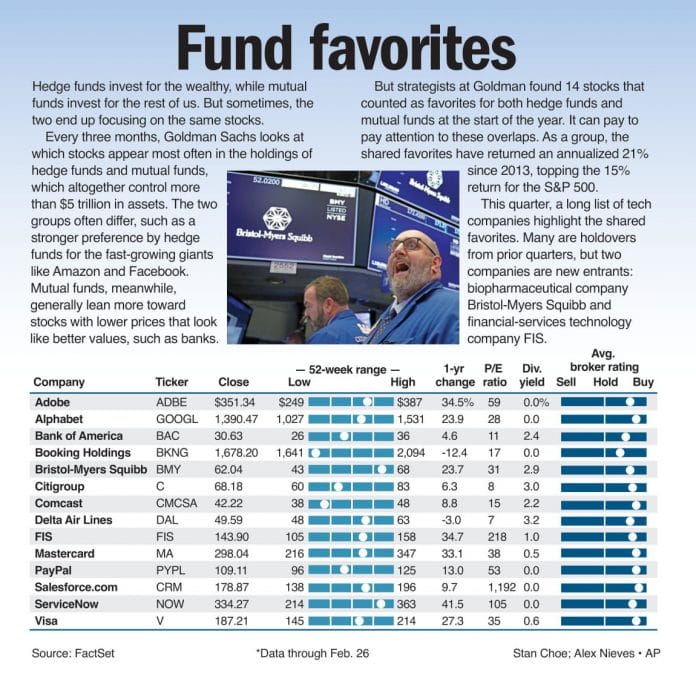

Hedge funds invest for the wealthy, while mutual funds invest for the rest of us. But sometimes, the two end up focusing on the same stocks. Every three months, Goldman Sachs looks at which stocks appear most often in the holdings of hedge funds and mutual funds, which altogether control more than $5 trillion in assets. The two groups often differ, such as a stronger preference by hedge funds for the fast-growing giants like Amazon and Facebook. Mutual funds, meanwhile, generally lean more toward stocks with lower prices that look like better values, such as banks.

But strategists at Goldman found 14 stocks that counted as favorites for both hedge funds and mutual funds at the start of the year. It can pay to pay attention to these overlaps. As a group, the shared favorites have returned an annualized 21% since 2013, topping the 15% return for the S&P 500. This quarter, a long list of tech companies highlight the shared favorites. Many are holdovers from prior quarters, but two companies are new entrants: biopharmaceutical company Bristol-Myers Squibb and financial-servic