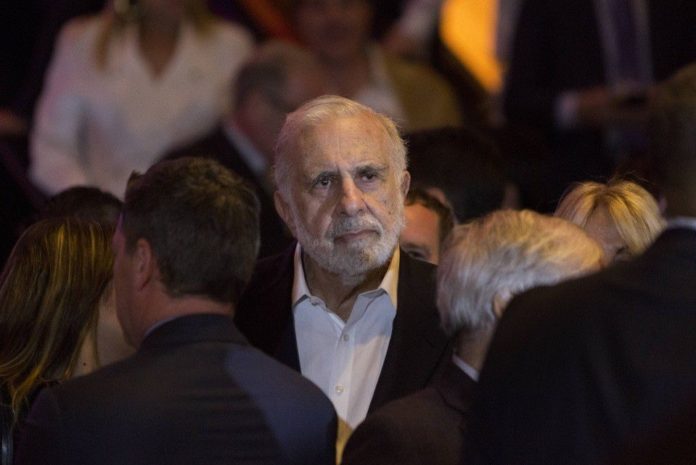

Billionaire investor Carl Icahn said his decision to cut his stake in shale driller Chesapeake Energy Corp. by more than half to 4.6 percent was for tax reasons, and he retains his confidence in the company’s top executives.

Icahn, the activist investor who helped lead the shareholder revolt that toppled Chesapeake’s co-founder, the late Aubrey McClendon, in 2013, is no longer the Oklahoma City-based explorer’s biggest holder after disclosing the change in a filing on Monday. Chesapeake shares fell 7.4 percent to $6.81 Monday.

Icahn began amassing significant amounts of Chesapeake stock during the second quarter of 2012, when the shares traded between about $12.60 and $22.40. At that time, McClendon was already embroiled in a controversy over his use of stakes in company-operated gas wells to secure hundreds of millions in personal loans. McClendon was replaced by Icahn’s hand-picked candidate, former Anadarko Petroleum Corp. deep-sea drilling expert Doug Lawler.

Icahn Enterprises LP, the billionaire’s publicly traded holding company, has declined almost 30 percent in the past 12 months, hurt in part by energy investments including Chesapeake and natural gas exporter Cheniere Energy Inc. Icahn’s commodity-exposed holdings also include refiner CVR Energy Inc., driller Transocean Ltd., and copper miner Freeport-McMoRan Inc.

Gordon Pennoyer, a Chesapeake spokesman, declined to comment on Icahn’s stock sale.

CVR Refining LP has dropped 48 percent this year, the worst-performer in a Bloomberg Intelligence index of refiners. CVR and other independent fuel makers that don’t own retail arms have been hit by the rising cost of ethanol-blending credits, or RINs. Icahn wrote in an Aug. 9 letter to Environmental Protection Agency administrators Gina McCarthy and Janet McCabe that “the RIN market will cause a number of refinery bankruptcies.”

A heavy debt load and weak energy prices have weighed on Chesapeake, the second-largest U.S. natural gas producer. Icahn said in a statement on his blog that he sold part of his stake for tax reasons, and remains confident in the company’s leadership.

“We believe that over the last few years Doug Lawler and his team have done an admirable job, especially in light of the circumstances,” Icahn wrote. “We reduced our position to recognize a capital loss for tax planning purposes.”