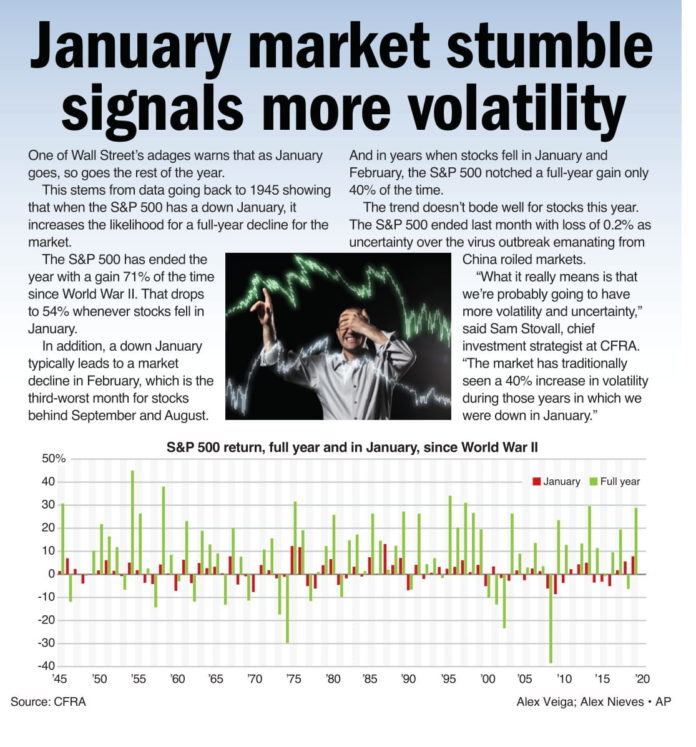

One of Wall Street’s adages warns that as January goes, so goes the rest of the year. This stems from data going back to 1945 showing that when the S&P 500 has a down January, it increases the likelihood for a full-year decline for the market. The S&P 500 has ended the year with a gain 71% of the time since World War II. That drops to 54% whenever stocks fell in January. In addition, a down January typically leads to a market decline in February, which is the third-worst month for stocks behind September and August.

And in years when stocks fell in January and February, the S&P 500 notched a full-year gain only 40% of the time. The trend doesn’t bode well for stocks this year. The S&P 500 ended last month with loss of 0.2% as uncertainty over the virus outbreak emanating from China roiled markets. “What it really means is that we’re probably going to have more volatility and uncertainty,” said Sam Stovall, chief investment strategist at CFRA. “The market has traditionally seen a 40% increase in volatility during those years in which we were down in January.”