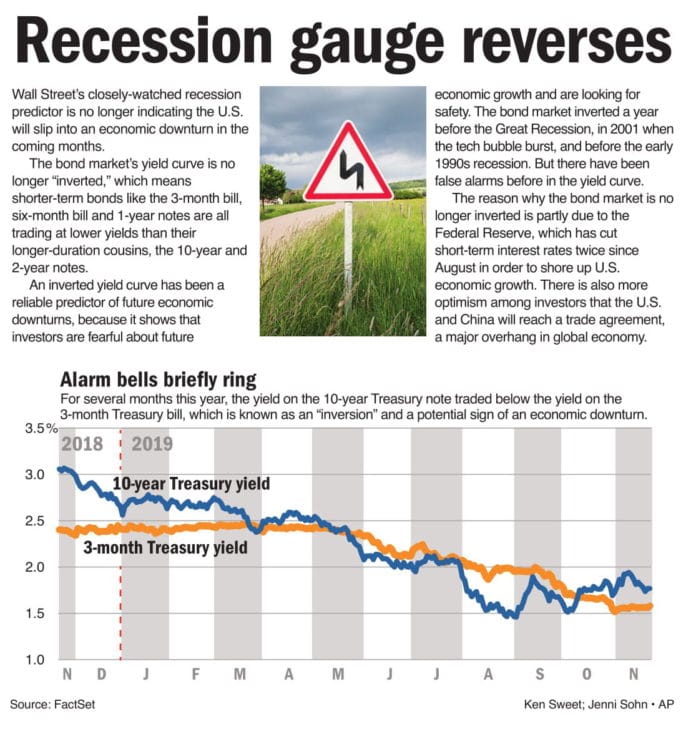

Wall Street’s closely-watched recession predictor is no longer indicating the U.S. will slip into an economic downturn in the coming months. The bond market’s yield curve is no longer “inverted,” which means shorter-term bonds like the 3-month bill, six-month bill and 1-year notes are all trading at lower yields than their longer-duration cousins, the 10-year and 2-year notes. An inverted yield curve has been a reliable predictor of future economic downturns, because it shows that investors are fearful about future

economic growth and are looking for safety. The bond market inverted a year before the Great Recession, in 2001 when the tech bubble burst, and before the early 1990s recession. But there have been false alarms before in the yield curve. The reason why the bond market is no longer inverted is partly due to the Federal Reserve, which has cut short-term interest rates twice since August in order to shore up U.S. economic growth. There is also more optimism among investors that the U.S. and China will reach a trade agreement, a major overhang in global economy