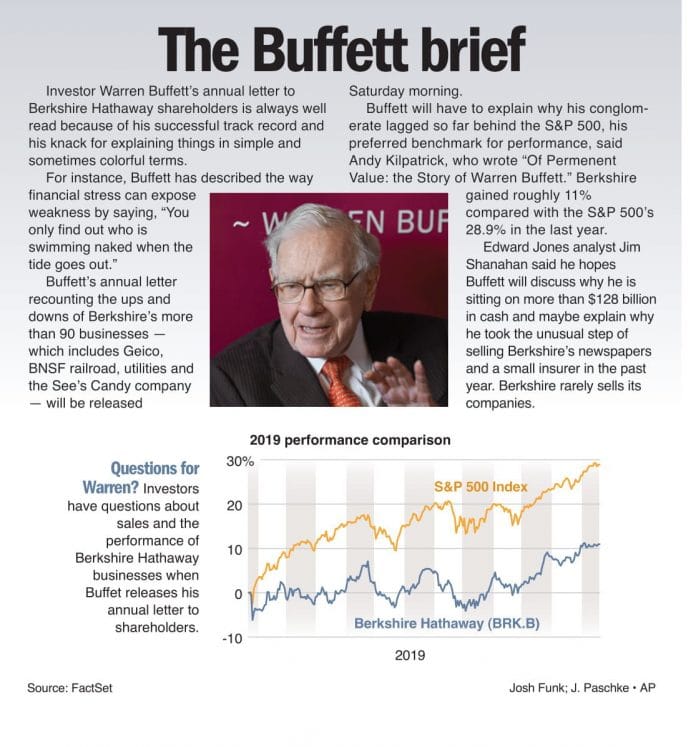

Investor Warren Buffett’s annual letter to Berkshire Hathaway shareholders is always well read because of his successful track record and his knack for explaining things in simple and sometimes colorful terms. For instance, Buffett has described the way financial stress can expose weakness by saying, “You only find out who is swimming naked when the tide goes out.” Buffett’s annual letter recounting the ups and downs of Berkshire’s more than 90 businesses — which includes Geico, BNSF railroad, utilities and the See’s Candy company — will be released Saturday morning. Buffett will have to explain why his conglomerate lagged so far behind the S&P 500, his preferred benchmark for performance, said Andy Kilpatrick, who wrote “Of Permenent Value: the Story of Warren Buffett.” Berkshire gained roughly 11% compared with the S&P 500’s 28.9% in the last year. Edward Jones analyst Jim Shanahan said he hopes Buffett will discuss why he is sitting on more than $128 billion in cash and maybe explain why he took the unusual step of selling Berkshire’s newspapers and a small insurer in the past year. Berkshire rarely sells its companies.