(BPT) – If you are a young professional, you are likely already making financial choices at work and home that critically affect your future. But are you taking advantage of every available opportunity to help protect your assets? Perhaps no aspect of financial planning gets overlooked more than life insurance.

You might think life coverage is something you won’t need to think about until much later in life. But life coverage can help give financial peace of mind for those who depend on you, no matter how young you are.

Not convinced? Check out these three reasons why life insurance can be a wise financial investment.

Financial protection without a high price tag. Contrary to popular belief, life coverage doesn’t have to be expensive. A 2019 study gives this example1: How much do you think a healthy 30-year-old will pay for $250,000 in term life insurance? If you said $500 a year or more, you agree with over half of those asked the same question — but you’d also be wrong. Would it surprise you that it is more like an average of $160 a year?

While the cost of life insurance varies for each person, one thing is for sure: Costs are likely to increase the older you get — all the more reason to jump on it early. You can usually lock in a lower premium rate when you invest in life coverage at a younger age that continues with you as you get older. In other words, financial protection without crazy-high costs.

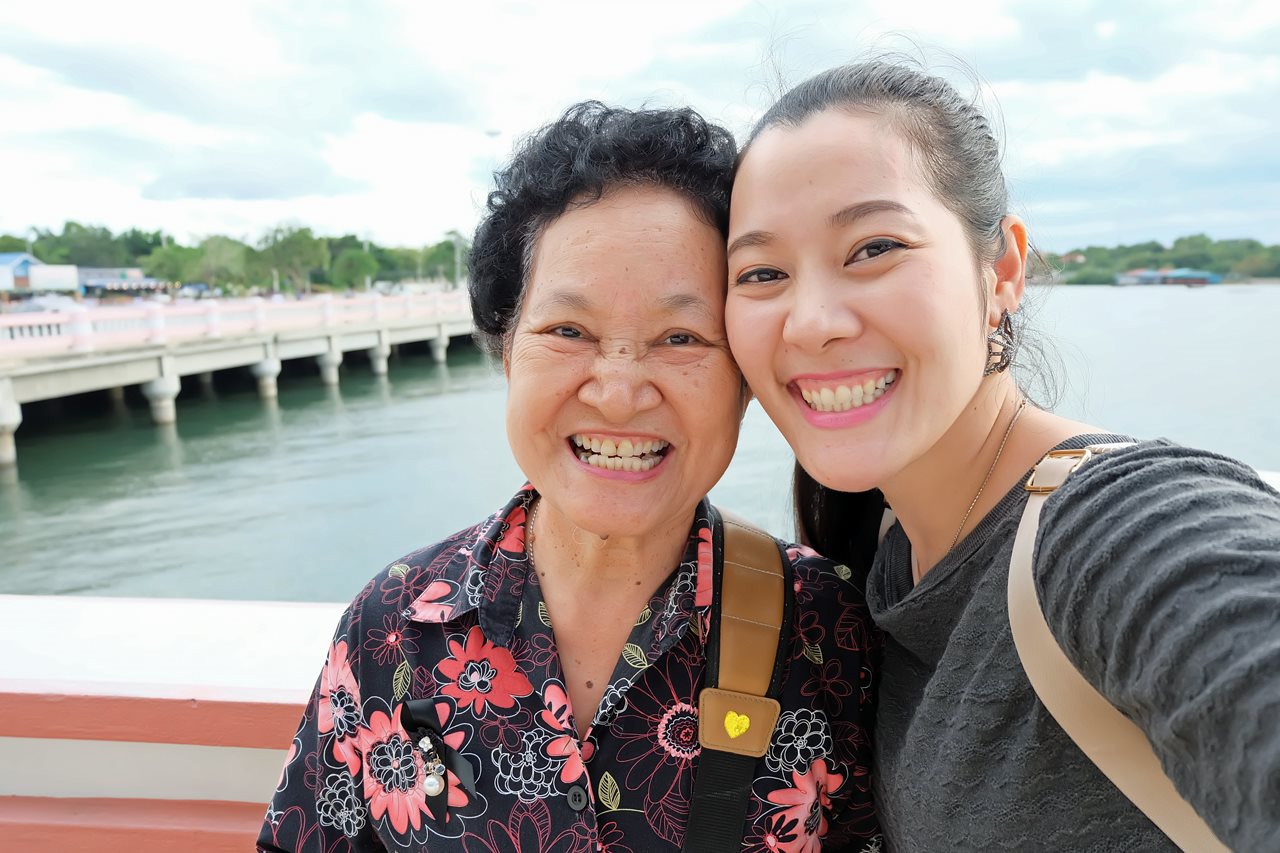

Maintain your family’s lifestyle. It can be easy to see how life insurance is important for families with only one primary wage-earner. But what about families who depend on two incomes? After all, dual-income households make up 48.8% of families without kids and 63% of families with kids.2 It is vital for these families to consider their living expenses and how their lifestyle might be affected financially if a wage-earner’s income ceases. That means taking into consideration how life coverage can help support present costs like the mortgage as well as future costs like a child’s college tuition.

Avoid financial burden for loved ones. Life coverage helps with final expenses, including funeral costs, medical bills and outstanding debt like student loans or credit cards. This can be especially difficult if you are one of the 10 million millennials in the U.S. who is a caregiver for an aging parent or grandparent.3 If these expenses are not considered, financial burden might fall on someone else’s shoulders. By investing in life coverage, you can help protect those you love from incurring additional financial stress while already dealing with the difficulty of losing a loved one.

No matter your age, there is significant value with life insurance — both in the immediate future and for the long term. Get to know what sets Aflac’s life coverage apart at Aflac.com/LifeInsurance.

1 The 2019 Insurance Barometer Study by LIMRA and Life Happens.

2 U.S. Bureau of Labor statistics.

3 “Millennials: The Emerging Generation of Family Caregivers” by AARP.

Aflac herein means American Family Life Assurance Company of Columbus and American Family Life Assurance Company of New York. WWHQ | 1932 Wynnton Road | Columbus, GA 31999.