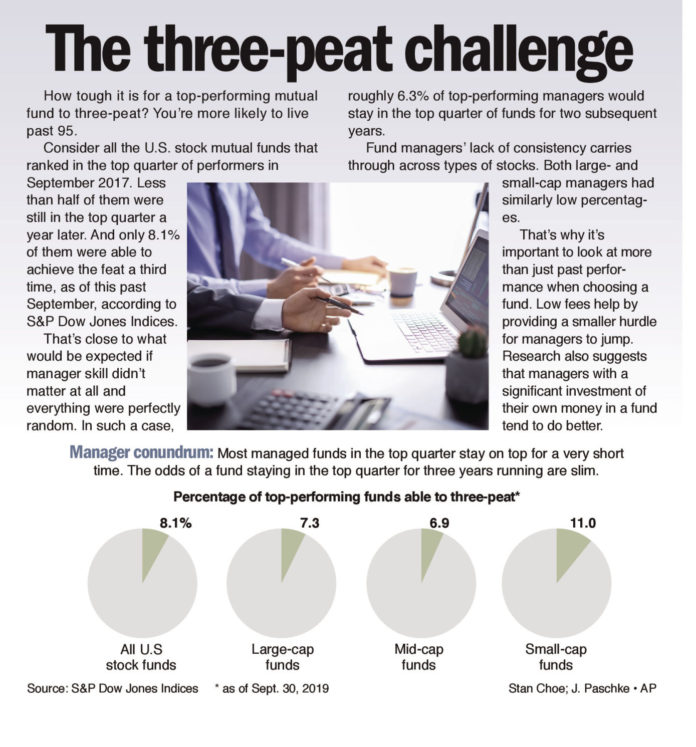

How tough it is for a top-performing mutual fund to three-peat? You’re more likely to live past 95. Consider all the U.S. stock mutual funds that ranked in the top quarter of performers in September 2017.

Less than half of them were still in the top quarter a year later. And only 8.1% of them were able to achieve the feat a third time, as of this past September, according to S&P Dow Jones Indices. That’s close to what would be expected if manager skill didn’t matter at all and everything were perfectly random.

In such a case, roughly 6.3% of top-performing managers would stay in the top quarter of funds for two subsequent years. Fund managers’ lack of consistency carries through across types of stocks. Both large- and small-cap managers had similarly low percentages. That’s why it’s important to look at more than just past performance when choosing a fund. Low fees help by providing a smaller hurdle for managers to jump. Research also suggests that managers with a significant investment of their own money in a fund tend to do better