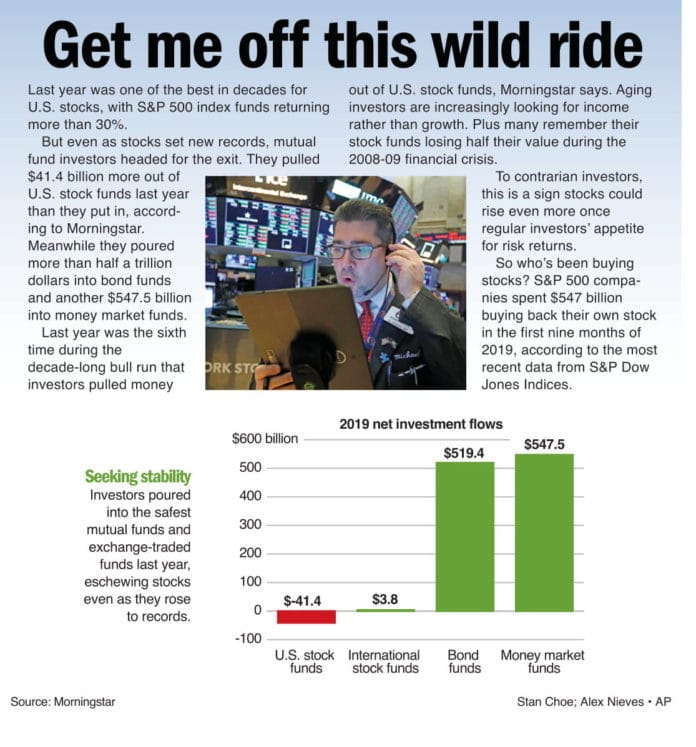

Last year was one of the best in decades for U.S. stocks, with S&P 500 index funds returning more than 30%. But even as stocks set new records, mutual fund investors headed for the exit. They pulled $41.4 billion more out of U.S. stock funds last year than they put in, according to Morningstar. Meanwhile they poured more than half a trillion dollars into bond funds and another $547.5 billion into money market funds. Last year was the sixth time during the decade-long bull run that investors pulled money out of U.S. stock funds, Morningstar says. Aging investors are increasingly looking for income rather than growth. Plus many remember their stock funds losing half their value during the 2008-09 financial crisis. To contrarian investors, this is a sign stocks could rise even more once regular investors’ appetite for risk returns. So who’s been buying stocks? S&P 500 companies spent $547 billion buying back their own stock in the first nine months of 2019, according to the most recent data from S&P Dow Jones Indices. Get