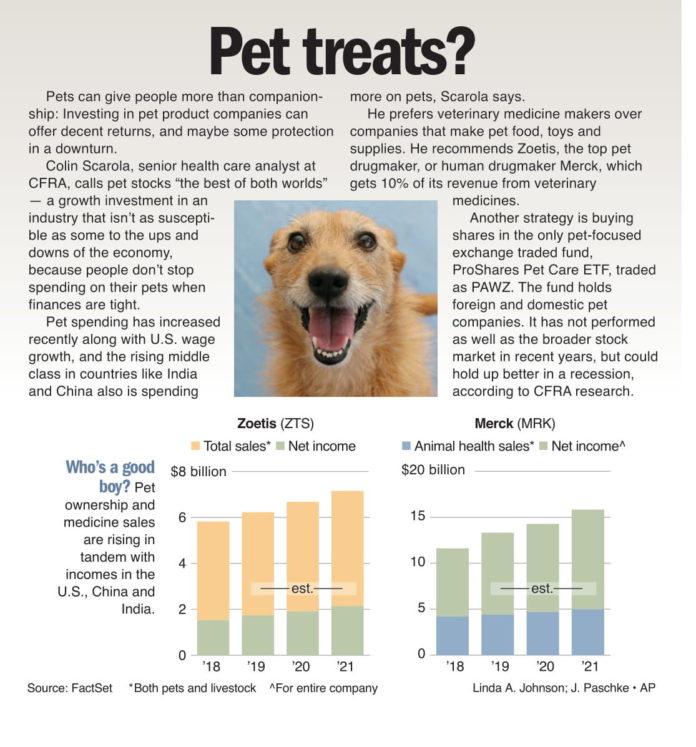

Pets can give people more than companionship: Investing in pet product companies can offer decent returns, and maybe some protection in a downturn. Colin Scarola, senior health care analyst at CFRA, calls pet stocks “the best of both worlds” — a growth investment in an industry that isn’t as susceptible as some to the ups and downs of the economy, because people don’t stop spending on their pets when finances are tight. Pet spending has increased recently along with U.S. wage growth, and the rising middle class in countries like India and China also is spending more on pets, Scarola says. He prefers veterinary medicine makers over companies that make pet food, toys and supplies. He recommends Zoetis, the top pet drugmaker, or human drugmaker Merck, which gets 10% of its revenue from veterinary medicines. Another strategy is buying shares in the only pet-focused exchange traded fund, ProShares Pet Care ETF, traded as PAWZ. The fund holds foreign and domestic pet companies. It has not performed as well as the broader stock market in recent years, but could hold up better in a recession, according to CFRA researc