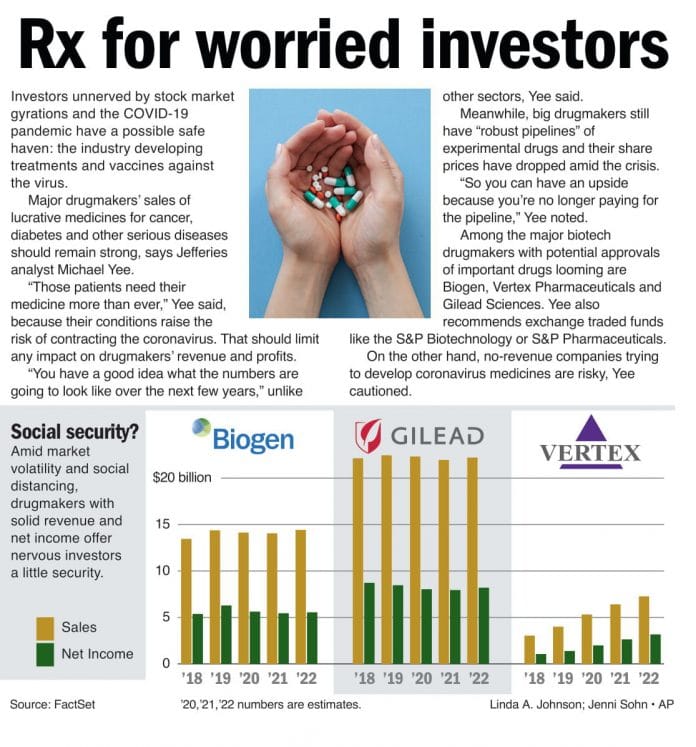

Investors unnerved by stock market gyrations and the COVID-19 pandemic have a possible safe haven: the industry developing treatments and vaccines against the virus. Major drugmakers’ sales of lucrative medicines for cancer, diabetes and other serious diseases should remain strong, says Jefferies analyst Michael Yee. “Those patients need their medicine more than ever,” Yee said, because their conditions raise the risk of contracting the coronavirus. That should limit any impact on drugmakers’ revenue and profits. “You have a good idea what the numbers are going to look like over the next few years,” unlike other sectors, Yee said. Meanwhile, big drugmakers still have “robust pipelines” of experimental drugs and their share prices have dropped amid the crisis. “So you can have an upside because you’re no longer paying for the pipeline,” Yee noted. Among the major biotech drugmakers with potential approvals of important drugs looming are Biogen, Vertex Pharmaceuticals and Gilead Sciences. Yee also recommends exchange traded funds like the S&P Biotechnology or S&P Pharmaceuticals. On the other hand, no-revenue companies trying to develop coronavirus medicines are risky, Yee cautioned