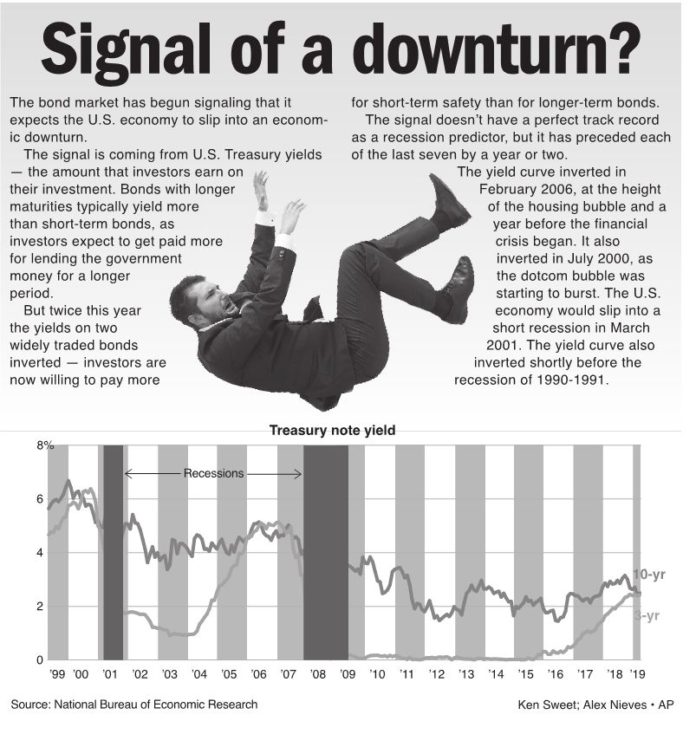

The bond market has begun signaling that it

expects the U.S. economy to slip into an economic

downturn.

The signal is coming from U.S. Treasury yields

— the amount that investors earn on

their investment. Bonds with longer

maturities typically yield more

than short-term bonds, as

investors expect to get paid more

for lending the government

money for a longer

period.

But twice this year

the yields on two

widely traded bonds

inverted — investors are

now willing to pay more

for short-term safety than for longer-term bonds.

The signal doesn’t have a perfect track record

as a recession predictor, but it has preceded each

of the last seven by a year or two.

The yield curve inverted in

February 2006, at the height

of the housing bubble and a

year before the financial

crisis began. It also

inverted in July 2000, as

the dotcom bubble was

starting to burst. The U.S.

economy would slip into a

short recession in March

2001. The yield curve also

inverted shortly before the

recession of 1990-1991