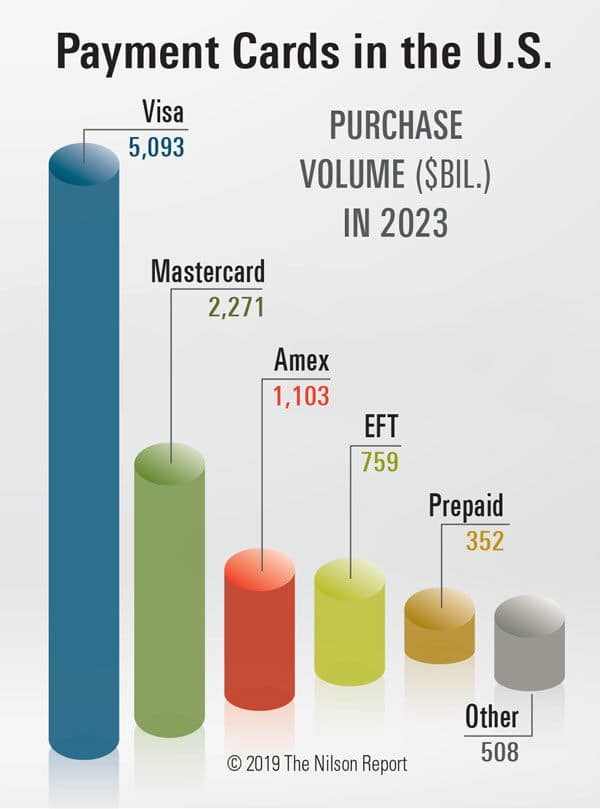

Spending for goods and services initiated by credit, debit, and prepaid cards issued in the United States, which totaled $7.266 trillion in 2018, is projected to reach $10.086 trillion in 2023 according to statistics released this week from The Nilson Report, a card and mobile payment industry trade publication.

At the end of 2018, there were 6.96 billion credit, debit, and prepaid cards in circulation in the U.S. That total is expected to reach 8.02 billion at the end of 2023.

“When nearly 7 billion payment cards generate more than $7 trillion in purchases of goods and services…you have to conclude the state of the card business is very good,” said David Robertson, publisher of The Nilson Report.

Credit cards accounted for 54.17% of spending on all types of cards, down from 54.37% in 2017. Spending on credit cards is project to account for 54.13% in 2023. Outstanding credit card debt was $1.124 trillion at the end of 2018, an increase of 5.8%. Outstandings are projected to reach $1.435 trillion by the end of 2023.

The average amount of a credit card purchase transaction was $90.73 in 2018, up from $89.88 in 2017. In 2023, the average amount is projected to be $94.44.

Payment cards in circulation include general purpose type (Visa, Mastercard, American Express, and Discover), PIN-debit type (Star, Nyce, Pulse, etc.), as well as private label type (store, gasoline, medical, hotel, airline), ACH, and private label prepaid, etc.