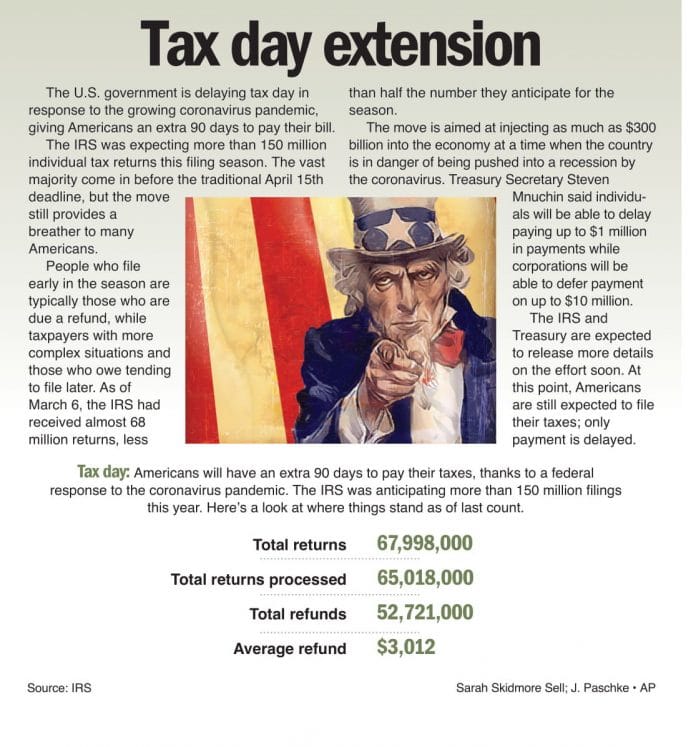

The U.S. government is delaying tax day in response to the growing coronavirus pandemic, giving Americans an extra 90 days to pay their bill. The IRS was expecting more than 150 million individual tax returns this filing season. The vast majority come in before the traditional April 15th deadline, but the move still provides a breather to many Americans. People who file early in the season are typically those who are due a refund, while taxpayers with more complex situations and those who owe tending to file later. As of March 6, the IRS had received almost 68 million returns, less than half the number they anticipate for the season. The move is aimed at injecting as much as $300 billion into the economy at a time when the country is in danger of being pushed into a recession by the coronavirus. Treasury Secretary Steven Mnuchin said individuals will be able to delay paying up to $1 million in payments while corporations will be able to defer payment on up to $10 million. The IRS and Treasury are expected to release more details on the effort soon. At this point, Americans are still expected to file their taxes; only payment is delayed.