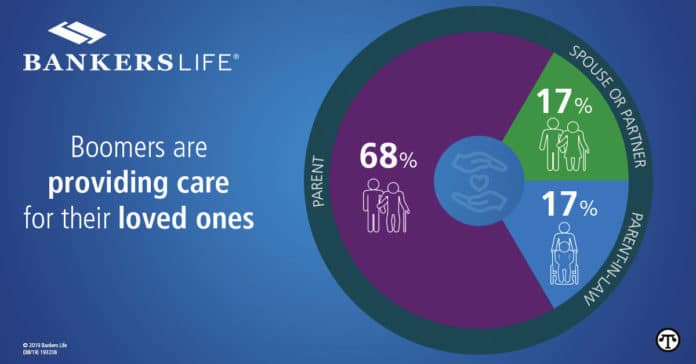

(NAPSI)—According to the U.S. Census, by 2035, older generations are projected to outnumber children for the first time in U.S. history, thus increasing the need for caregivers. Millions of adults, including Boomers, are already taking care of loved ones and facing new realities that require sacrifices to provide care.

Research from the Bankers Life Center for a Secure Retirement shows that among Boomers who expect to be future caregivers, nearly all (92%) are willing to make lifestyle sacrifices in order to provide that care.1 And although awareness about the need for retirement care is growing, Boomers remain financially unprepared. According to the study, one-third (30%) of Boomers who are caregivers have had to tap into their own nest eggs to support the care of a parent or loved one.

National Family Caregivers Month is a great time to develop a plan that balances retirement planning and long-term caregiving. Here are three steps to take to ensure you’re financially prepared:

1. Develop a budget.

The U.S. Department of Health & Human Services estimates that Boomers will face an average of $138,000 in long-term care costs over their lifetimes. Though this cost is simply an average, it may fluctuate depending on your health as you age. Plan ahead and create a budget that addresses both your retirement needs and possible expenses, including costs related to necessary home modifications.

2. Consider long-term care insurance.

Long-term care insurance can help save thousands in caregiving expenses. It’s a good idea to have a conversation with your loved ones to discuss insurance options. This ensures that the costs are not transferred over completely to you.

3. Don’t know where to start? Get help.

With so many details to consider, enlist support. Professional financial advisors can shape a personalized plan that prepares for retirement and accounts for unforeseen expenses. Bankers Life, a national life and health insurer, offers tools and resources that can help protect retirement nest eggs from the high costs of long-term care.

There are options available for nearly any income and asset level, age, or risk tolerance. It is never too late to seek help and develop a better understanding of how to prepare for the future.

1Bankers Life Center for a Secure Retirement (CSR) study A Growing Urgency: Retirement Care Realities for Middle-Income Boomers

This article provides general, educational information and does not provide legal, tax or investment advice. Nothing in this article is intended to be a solicitation of insurance in any jurisdiction. Its purpose is the promotion of interest in Bankers Life and insurance in general. Any inquiries regarding the possible purchase of an insurance policy will be directed to a licensed insurance agent/producer, in which event an insurance agent/producer may contact you.

Bankers Life is the marketing brand of Bankers Life and Casualty Company, Medicare Supplement insurance policies sold by Colonial Penn Life Insurance Company and select policies sold in New York by Bankers Conseco Life Insurance Company (BCLIC). BCLIC is authorized to sell insurance in New York.

![]() “Professional financial advisors can shape a personalized plan that prepares for retirement and accounts for unforeseen expenses. Bankers Life offers tools and resources to help protect retirement nest eggs from the high costs of long-term care. http://bit.ly/2rslU6B”

“Professional financial advisors can shape a personalized plan that prepares for retirement and accounts for unforeseen expenses. Bankers Life offers tools and resources to help protect retirement nest eggs from the high costs of long-term care. http://bit.ly/2rslU6B”

On the Net:North American Precis Syndicate, Inc.(NAPSI)