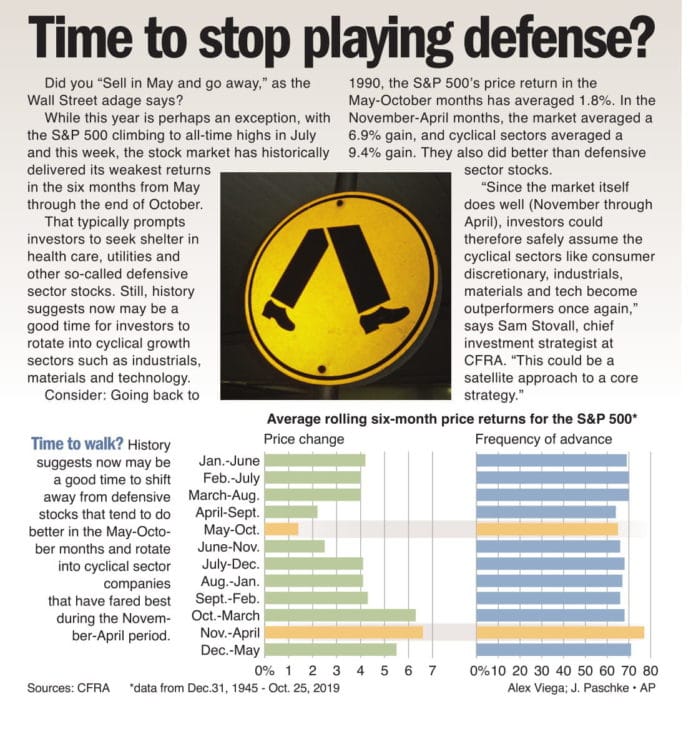

Did you “Sell in May and go away,” as the Wall Street adage says? While this year is perhaps an exception, with the S&P 500 climbing to all-time highs in July and this week, the stock market has historically delivered its weakest returns in the six months from May through the end of October. That typically prompts investors to seek shelter in health care, utilities and other so-called defensive sector stocks. Still, history suggests now may be a good time for investors to rotate into cyclical growth sectors such as industrials, materials and technology. Consider: Going back to 1990, the S&P 500’s price return in the May-October months has averaged 1.8%. In the November-April months, the market averaged a 6.9% gain, and cyclical sectors averaged a 9.4% gain.

They also did better than defensive sector stocks. “Since the market itself does well (November through April), investors could therefore safely assume the cyclical sectors like consumer discretionary, industrials, materials and tech become outperformers once again,” says Sam Stovall, chief investment strategist at CFRA. “This could be a satellite approach to a core strategy.”