Two cities in Texas rate high in using the biggest portion of their credit cards’ available credit, according to a new report from CompareCards.com. San Antonio rates No. 1, while Houston is No. 3. Fort Worth and Dallas can breathe a little easier. DFW comes in at No. 33.

In Dallas-Fort Worth the average credit card balance is $5,343 and the credit card utilization rate is 29.6 percent.

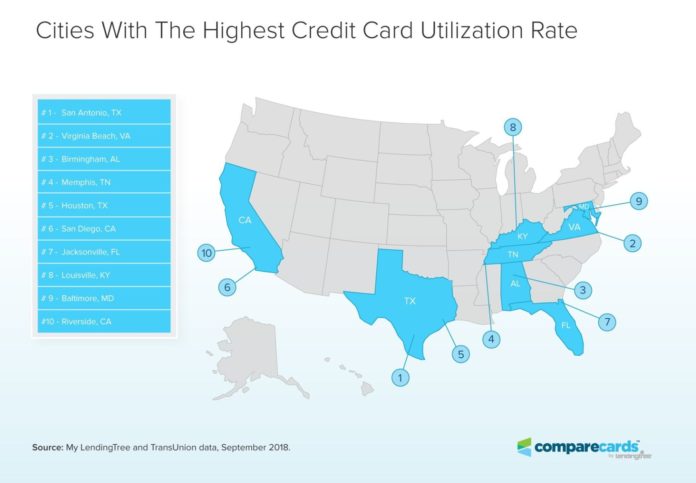

Credit card utilization rate, the comparison of a credit card balance to available credit, is the second-most important factor in credit scoring formulas behind payment history. CompareCards used September 2018 user data from My LendingTree to examine credit card utilization rates among cardholders with a balance in the nation’s 50 largest metropolitan areas. The analysis found that San Antonio cardholders had the highest rate, cardholders in the San Francisco Bay area had the lowest, and a real north-south divide exists when it comes to credit card utilization.

Key findings:

• Highest rates: San Antonio had the highest credit card utilization rate at 35.1 percent, while Virginia Beach, Va.; Birmingham, Ala.; Memphis, Tenn.; and Houston rounded out the top five.

• Lowest rates: San Jose, Calif., had the lowest credit card utilization rate at 23.8 percent. Its Bay Area neighbor, San Francisco/Oakland, was second at 26 percent, followed by Minneapolis/St. Paul, Minn.; Raleigh, N.C.; and Denver.

• The average utilization rate among the 50 biggest cities was 30.2 percent. Most experts recommend that consumers keep their rate no higher than 30 percent.

• Just 14 of the 50 biggest cities had utilization rates below 30 percent, when you include rounding.

• The eight cities with the highest credit card utilization rates are all in the southern U.S., while five of the six cities with the lowest utilization rates are in the northern part of the country.

• For many of these cities, it’s all about income. With a few exceptions, most of the cities with the highest utilization rates were among those with the lowest household incomes, while higher income cities tended to have lower rates.

“For those in my hometown of San Antonio, it’s important to understand that if your credit utilization rate is too high, your credit scores will suffer,” said Matt Schulz, Chief Industry Analyst at CompareCards. “The good news, however, is that you have much more power to change that rate than you realize. Unlike a late payment, which can stain your credit for years and you can’t really do much to fix, there are steps you can take to get your utilization rate back in shape.”

Schulz continued, “Obviously, the best way to improve your utilization is to pay down your credit card debt. If you can’t afford to change the balance side of the equation, try to change the credit limit side by calling your credit card issuer and asking for an increase in your credit limit. Just remember not to go on a shopping spree with that newly available credit. A new card can also be a very effective way to improve your utilization. If you can keep your balances the same while adding more available credit, your overall utilization rate across several cards will improve your credit score.”

www.comparecards.com.