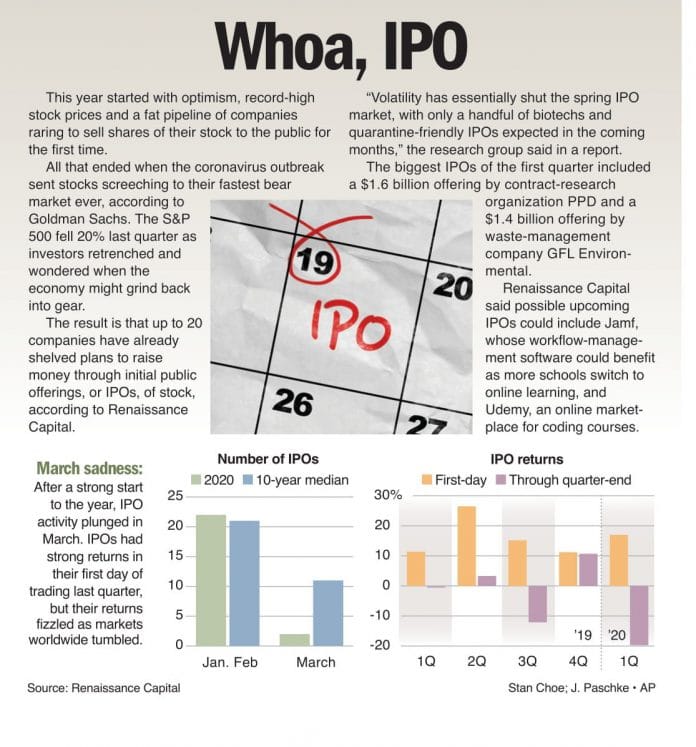

This year started with optimism, record-high stock prices and a fat pipeline of companies raring to sell shares of their stock to the public for the first time. All that ended when the coronavirus outbreak sent stocks screeching to their fastest bear market ever, according to Goldman Sachs. The S&P 500 fell 20% last quarter as investors retrenched and wondered when the economy might grind back into gear. The result is that up to 20 companies have already shelved plans to raise money through initial public offerings, or IPOs, of stock, according to Renaissance Capital.

“Volatility has essentially shut the spring IPO market, with only a handful of biotechs and quarantine-friendly IPOs expected in the coming months,” the research group said in a report. The biggest IPOs of the first quarter included a $1.6 billion offering by contract-research organization PPD and a $1.4 billion offering by waste-management company GFL Environmental. Renaissance Capital said possible upcoming IPOs could include Jamf, whose workflow-management software could benefit as more schools switch to online learning, and Udemy, an online marketplace for coding courses.