Every year at about this time, articles appear in various publications regarding year-end tax planning. These typically focus on reducing your tax burden by shifting income between tax years, increasing retirement plan contributions, harvesting investment losses, and increasing charitable contributions.

Unfortunately, there is seldom any discussion of the most tax efficient ways to make charitable contributions. One method is to use a donor advised fund (DAF). Doing so can multiply the impact of gifts, reduce ordinary income taxes and, in some scenarios, permanently avoid the capital gains tax.

“Front Load” Your Annual Giving into a Donor Advised Fund (DAF)

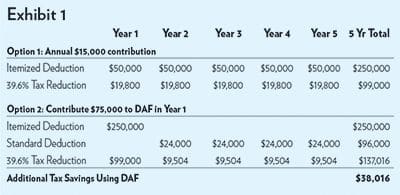

A DAF allows you to contribute to the fund, receive an immediate tax deduction, and recommend grants to charities from the fund in future years. EXHIBIT 1 shows the substantial tax savings gained by “front loading” several years’ worth of regular annual donations into the fund all at once.

For simplicity, assume a couple donates $50,000 annually to charity, has adjusted gross income (AGI) of $1,000,000 (39.6% ordinary income and 23.8% effective long-term capital gains tax brackets), and has no other itemized deductions. They also have a substantial amount in savings and investments that they have no plans to use in the next five years. The standard deduction proposed by the Trump Plan for married couples filing a joint return is $24,000. Our couple currently itemizes their deductions each year because they exceed the standard deduction. Establishing a Donor Advised Fund instead reduces taxes owed by $38,016, an extra 38% over the 5-year period.

Contribute Appreciated Securities to a Donor Advised Fund

Much more effective than donating cash is contributing long-term appreciated securities. Our couple from EXHIBIT 1 owns shares of stock currently valued at $250,000 for which they paid $60,000 (their cost basis). Rather than donating cash to set up the DAF in year 1, they can use the securities by either 1) selling them and donating the proceeds to the DAF or 2) donating the actual shares to the foundation, which will then sell them and place the proceeds in the DAF.

Except for those in the lowest tax brackets with a 0% long-term capital gains rate, selling securities to make charitable donations will eat up some of the tax benefit because of capital gains taxes. However, donating long-term appreciated assets directly avoids entirely the capital gains tax, allows you to make the same gift for a much lower cost, and dramatically increases the amount of tax savings. In our example, the couple creates the same $750,000 value in their DAF but at a cost of only the $60,000 basis, and they save $83,236 compared to regular annual charitable contributions.

Fund a DAF When Selling a Business, Real Estate, Closely Held Stock, etc.

The perfect time to create a DAF is when you are considering the sale of a business, closely held stock, real estate, artwork, or other long-term appreciated assets. As in EXHIBIT B, you’ll receive a charitable deduction for the appraised fair market value and never have to pay capital gains tax on the appreciation. (However, if donated to a private foundation, the deduction is limited to cost basis.) See the inset for a story of a donor who did just this.

How Can the North Texas Community Foundation Help?

The North Texas Community Foundation (NTCF) is a local non-profit organization with deep roots in Tarrant and surrounding counties. Community foundations are pools of donor funds that are invested on behalf of the fund holders who advise regarding the charities and/or causes they wish to support. NTCF currently assists about 170 families invest and distribute grants from assets totaling approximately $290 million. The Foundation accepts a wide variety of assets, assists in structuring the most tax efficient donation for your unique situation and provides highly personalized service tailored to each fund holder’s unique objectives.

Note: Information contained in this article is not intended to constitute tax advice. Every taxpayer’s situation is unique and should be reviewed with your tax advisor. The examples may or may not be appropriate for your situation. Assumptions regarding changes related to the proposed Trump Tax plan are footnoted.

https://northtexascf.org/