Department stores are facing more challenges even as consumers remain financially healthy, according to Moody’s Investor Service. The rating agency said in a recent report it’s cutting its forecast for operating income in 2019 again to a 20% decline from a 15% decline. Moody’s just cut its sector forecast barely two months ago. It does see the declines abating in 2020. The revision comes as department stores like Kohl’s and Macy’s had a disappointing third quarter heading into the holidays. They’re wrestling with shoppers’ increasing shift online and stepped-up competition from the likes of T.J. Maxx, which are taking

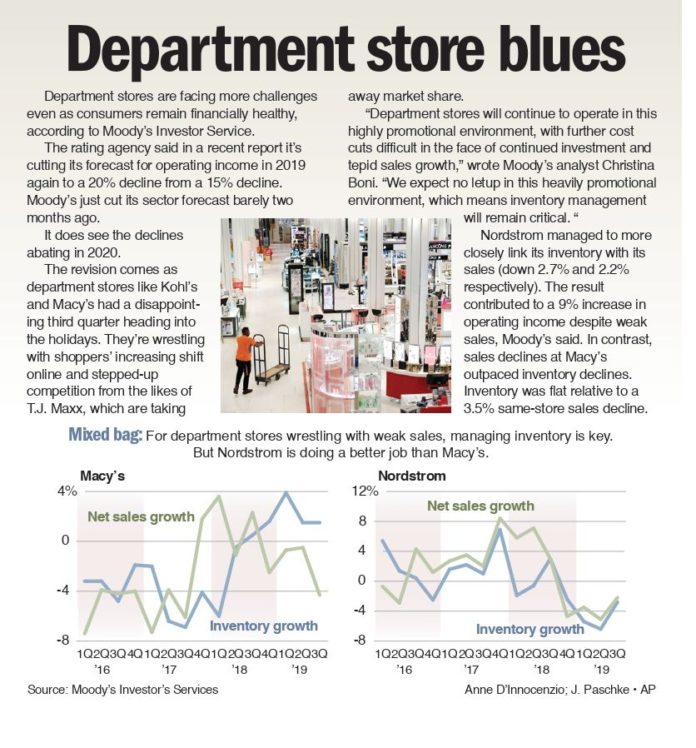

away market share. “Department stores will continue to operate in this highly promotional environment, with further cost cuts difficult in the face of continued investment and tepid sales growth,” wrote Moody’s analyst Christina Boni. “We expect no letup in this heavily promotional environment, which means inventory management will remain critical. “ Nordstrom managed to more closely link its inventory with its sales (down 2.7% and 2.2% respectively). The result contributed to a 9% increase in operating income despite weak sales, Moody’s said. In contrast, sales declines at Macy’s outpaced inventory declines. Inventory was flat relative to a 3.5% same-store sales decline.