When I wrote in October that the final round of ARPA (American Rescue Plan Act) grants through Gov. Abbott’s office was starting, little did I know that there could be a significant number of unallocated funds left over.

With $180 million available in $20,000 grants to businesses that lost sales in 2020 or 2021, it seemed reasonable that 9,000 businesses would file and qualify for the grants.

I was wrong.

As a result, the governor’s office has launched its absolute final call for applications for these grants that provide a one-time reimbursement to Texas-based private companies negatively impacted by Covid-19.

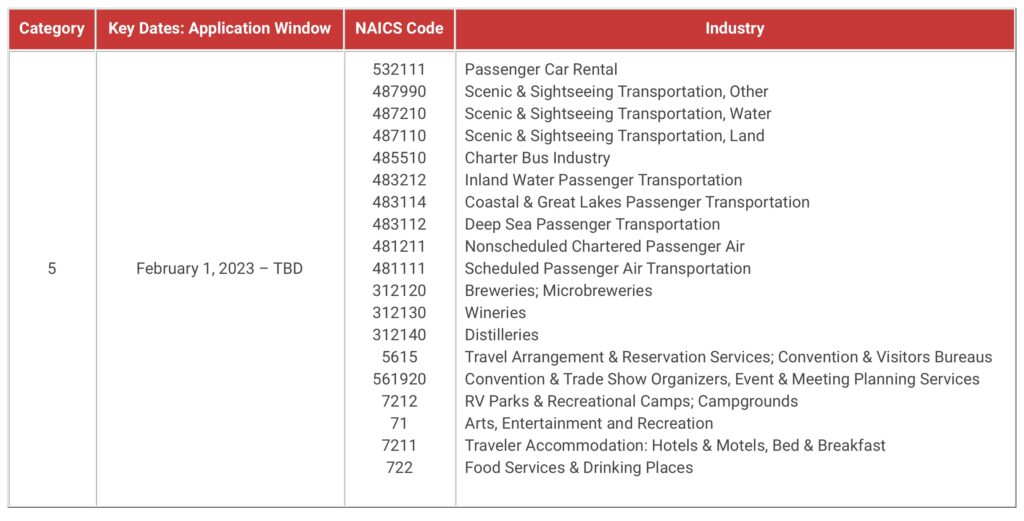

The latest group of eligible recipients consists of the travel industry with a focus on scenic and sightseeing services.

Reopening Grant Applicant Sectors

Since significant funds still remain, the Texas Travel Industry Recovery Grants program is reopening the original categories for new applications. Texas-based, privately-owned companies may apply in these categories if they did not apply previously in the summer or fall.

The new application period began Wednesday, Feb. 1.

Listed below are the categories and the corresponding NAICS (North American Industry Classification System) code:

Please understand that if the NAICS code is only a few digits, those numbers are the starting digits in the company’s full code.

Once again, breweries and microbreweries can apply, as can wineries and distilleries. Privately (non-government) venues and CVBs can apply, as can RV parks and campgrounds, plus arts, entertainment, and recreation (even minor league baseball teams!).

Hotels, motels, and B&Bs are eligible, as are restaurants and – I love this term – “drinking places.”

The criteria are very specific. A qualifying business must:

- have a NAICS code that begins with or consists of the listed digits

- have been in operation prior to January 20, 2020, and still be operating

- operate within the state of Texas (the applicant may have other operations outside of Texas, but only the Texas businesses will qualify for the grant)

- be either a privately-owned for-profit business or a non-profit organization, but it may NOT be a publicly held company listed on any stock exchange

- be open to the public or provide services for in-person events

- have suffered negative economic impact due to Covid-19 (gross sales decline)

- be otherwise eligible to receive grant funding and must not be barred from competing for federal awards

Critical criteria

In addition to showing lost sales, companies can help their cause by showing that they continued to pay rent, utilities, and employees. Applicants will need to document such expenses as well as any expenses they incurred to comply with social distancing and other precautions.

The following documentation is critical to the application process:

- IRS Form 941 for the most recent quarter filed for 2022 (signed and dated by the preparer and the company officer)

- IRS tax documents for 2019, 2020, and 2021 (signed and dated by the preparer and the company officer)

- Narrative that explains:

- How the applicant plans to apply the reimbursement funds if received, as well as proof (actual receipts) of any referenced expenses such as rent, utility bills, payroll, and/or contract labor.

- The negative impact suffered due to Covid-19

- How budget expenditures addressed the identified need or impact and must emphasize how they were deployed in response to the disease itself or the harmful consequences of the economic disruptions.

For complete information on the program, please visit the Texas Travel Industry Recovery grant program site online.

John Fletcher is the owner of Fletcher Consulting Public Relations, where he has successfully helped clients receive over $650,000 in government grants. His contact information is 817-205-2334 and his email address is john@thefletch.org.