Barnes & Noble, the one-time bookselling giant that

many blamed for the demise of independent bookstores

before it was in turn ravaged by

Amazon.com, is being acquired by

a hedge fund for $476 million.

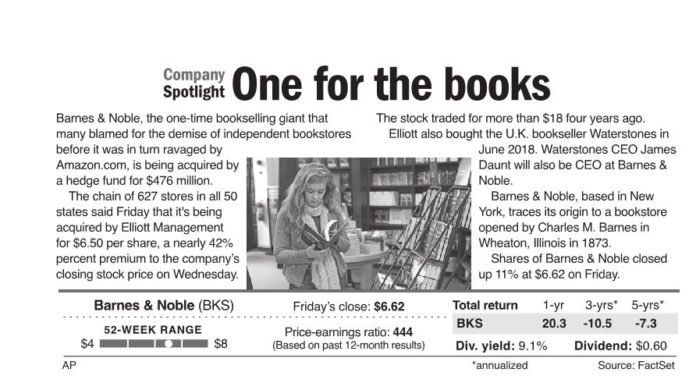

The chain of 627 stores in all 50

states said Friday that it’s being

acquired by Elliott Management

for $6.50 per share, a nearly 42%

percent premium to the company’s

closing stock price on Wednesday.

The stock traded for more than $18 four years ago.

Elliott also bought the U.K. bookseller Waterstones in

June 2018. Waterstones CEO James

Daunt will also be CEO at Barnes &

Noble.

Barnes & Noble, based in New

York, traces its origin to a bookstore

opened by Charles M. Barnes in

Wheaton, Illinois in 1873.

Shares of Barnes & Noble closed

up 11% at $6.62 on Friday.