New variants of coronavirus kept the economic recovery on a roller-coaster ride throughout 2021 as a steady stream of newcomers helped the commercial real state market in Fort Worth and Tarrant County ride out the unpredictability and even fare better than expected.

The construction market also faced a challenging year in 2021 and the contributing factors are continuing, according to Arthur Mironchuk, director of client services for the Beck Group.

“There were no surprises,” said Sarah LanCarte, owner of LanCarte Commercial, who moderated a panel discussion to lead off the 2022 Tarrant County Commercial Real Estate Forecast hosted by the Real Estate Council of Greater Fort Worth.

The forecast returned in-person Jan. 27 at the Fort Worth Convention Center after going virtual in 2021 due to the pandemic.

Overall, panelists as well as industry specialists – who presented updates of individual sectors within the market – were upbeat about 2021 results, although there were a few areas of difficulty.

The persistent challenges that cut across nearly all the real estate sectors are skyrocketing materials costs and staff shortages.

While construction activity and demand has been rising, the skilled labor pool is shrinking and the cost of materials is rising due to supply chain problems, Mironchuk said.

“The average age of a skilled craftsman is 51,” Mironchuk said. “By 2030, most of them will be retired.”

Robert Sturns, economic development director for the city of Fort Worth, said efforts have been underway through the community colleges to develop talent for the construction trades but it is now becoming necessary to engage high school students to consider good-paying, skilled labor jobs as well.

“The focus in education has been on college and degrees,” he said. “We’re going to work with the ISDs and work with the kids to grow talent focused on the trades.”

Sturns also pointed to weaknesses in the Fort Worth market that need improvement, particularly the need to increase wages.

“We need to put wage requirements in (economic development) incentive packages to attract more talent and corporate relocations,” Sturns said. “We’ve got to get out of this low-wage cycle.”

Despite materials and labor shortages, the Dallas-Fort Worth area is still one of the hottest in the country for new commercial construction and growth, with the prospects for 2022 offering “reasons to be excited,” Mironchuk said.

The office, retail and hospitality markets were the hardest hit, according to the experts at the Forecast. These areas face challenges that go beyond materials and labor shortages.

While the pandemic prevented a robust return of workers to their office jobs, there was a rebound throughout 2021 and that trend is likely to continue, barring a major resurgence of Covid 19, said Jessica Miller Essl, co-president of M2G Ventures, a commercial real estate investment, development and consulting firm specializing in adaptive reuse and industrial properties.

Even so, the office environment of the future may be a departure from the office work setup of the past. There is already a shift underway that Essl and others described as a “flight to quality.”

Instead of office space in tall tower buildings, offices of the future will likely be some type of hybrid model, combining a mix of work-at-home with in-office work.

“Hybrid is here to stay,” said Cannon Camp, a senior vice president with JLL in Fort Worth.

Business and professional services will likely favor more in-office days while the technology industry will likely lean toward remote.

The in-office experience of the future will likely be sprawling campuses over large campuses on large acreage tracts featuring extensive landscaping, walking paths and even water features.

Indoor amenities will include cafes, workout facilities, wellness centers and lounges and other amenities that appeal to workers, Camp said.

Camp said examples of developments on the horizon that fit the “flight to quality” profile include the Crescent Fort Worth, a mixed-used development in the Cultural District that combines luxury residential units, a hotel and 168,000 square feet of office space. Another is Hillwood Commons II, offering 135,295 square feet of office space in Alliance Town Center, which offers amenities such as dining, hotel and parks.

The pandemic shutdowns dealt painful blows to retail restaurants and hotels and some are still struggling to recover, according to Amber Calhoun, a commercial real estate broker at Graham Property Brokerage.

But nationally, retail sales jumped 19.3 percent in 2021 and retailers closed fewer stores in 2021 than in 2020. Retail absorption was more than 36.7 million square feet in the third quarter of 2021, according to a report from CBRE.

Investment in retail across the Dallas-Fort Worth area rebounded in 2021 after a dip during the pandemic shutdowns in 2020, she said.

Before the pandemic shutdowns, consumers were shifting more toward e-commerce and online shopping. The shutdowns hastened the move in that direction, Calhoun said, noting that at the beginning of 2020 about 17 percent of consumers were buying groceries online. By mid-2021, 51 percent of groceries were being bought online, she said.

Calhoun said grocery stores are expected to experience a turnaround because “people like the idea of walking down the aisles and picking their own produce.”

A shortage of workers and competition to hire workers has driven up labor costs, which also have adversely impacted restaurants and hotels, she said.

Yet, new developments like the Hotel Drover and Mule Alley in the Stockyards are thriving because they offer interesting and unique shopping, dining and hospitality opportunities, Calhoun said.

“Big box retailers are hard to get excited about,” said Ryan Dodson of Dodson Commercial Real Estate.

As for restaurants, larger operators will be the most successful because they can afford to pay staff better than the “mom and pops” that are struggling in this highly competitive market, Dodson said.

Sturns said that shopping malls “have to be flexible about repurposing.” Mixed-use developments are the trend of the future.

Commercial real estate sectors are continuing to prosper and thrive is the industrial market, where the DFW market remains the second largest in the United States, according to Reid Goetz, a senior vice president for Hillwood.

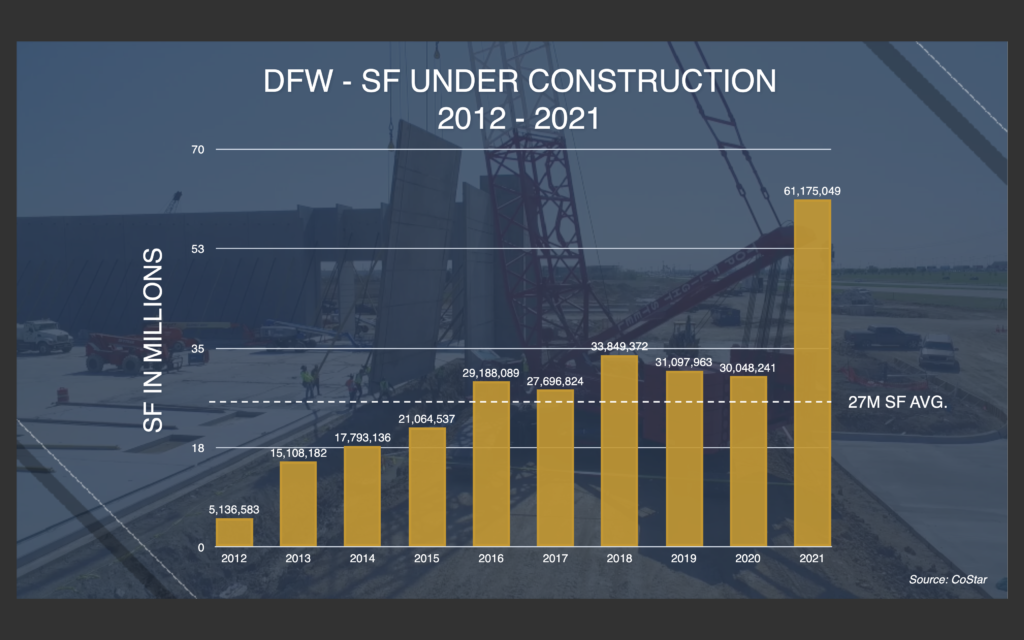

The total U.S. market has 17.6 billion square feet of industrial space and the Dallas-Fort Worth area accounts for 1 billion square feet of it. The DFW market also led the nation with 61.7 million square feet of new industrial space under construction and was also ranked first in the country for net absorption with 44.9 million square feet.

The multi-family market also performed well in 2021, driven by strong demand from population growth in the Dallas-Fort Worth area, although supply chain and worker shortages slowed construction starts in 2021, resulting in bumps in rental prices. That market is on par to do extremely well in 2022, said Drew Kile, senior managing director for Institutional Property Advisors, a Marcus & Millichap Company.

Compared with other metro markets across the county, the Dallas-Fort Worth area ranked in first place in eight of nine categories measured in the multi-family outlook. Those categories include population growth, apartment net absorption, apartment completions and the number of 20- to 34-year-olds added to the market, according to Kile’s report.

As a result, rents increased sharply over the past year, with middle- and working-class tenants living in Class C category apartments spending 30 percent of their income on rent. Class B tenants are spending 20 percent of their incomes on rent while higher-income Class A renters spend 15.5 percent of their incomes on rent.

“No one is happy with the cost increases we’ve seen in rent,” Kile said.

Rent prices are driven by supply and demand and Fort Worth’s apartment vacancy rate is 3.1 percent, hovering just above of Dallas’ at 2.9 percent and the national rate of 2.6 percent.

Kile predicted that rent will increase 14 percent this year and permits for new apartment development will increase by late in the year and early in 2023.

This year’s forecast also featured a panel discussion with Fort Worth Mayor Mattie Parker, Tarrant County Judge Glen Whitley and Arlington Mayor Jim Ross, who all spoke about their agencies’ growth and development outlook for 2022 and their efforts at inter-agency collaboration to improve the lives of residents with expansion of early childhood education opportunities helping women return to the workforce, improving public health and tackling homelessness, among other priorities.

Presenting sponsors of the Forecast were Beck, the Fort Worth Business Press, the Fort Worth Chamber of Commerce, Peloton Land Solutions, Jackson Walker, JLL, Rattikin Title, Southland, Texas Capital Bank, and Weaver.

Supporting sponsors were Calvetti Ferguson, Hillwood, Mason Joseph Co., Pape-Dawson Engineers, Red Oak Realty, Republic Title, Shield Engineering Group, and Southside Bank. Refreshment sponsors were Clearfork, Corinth Land, Gorrondona & Associates Inc., IntegraTax Inc., Mercantile Center, Riner Engineering, the Rios Group, and WhitleyPenn.