“Lack of inventory and a whole lot of buyers.”

That’s how Bryan Cox, a North Texas Realtor with RE/MAX DFW Associates sums up the current situation for he and fellow realtors in the area.

“There are multiple offers everywhere,” he said. “I think it’s, in some areas, leveled out a little bit where you’re only seeing 10 offers, instead of 60 or 70, but certainly your Collin County is still going to be 50, 60 plus offers at times. So I think that’s still pretty prevalent.”

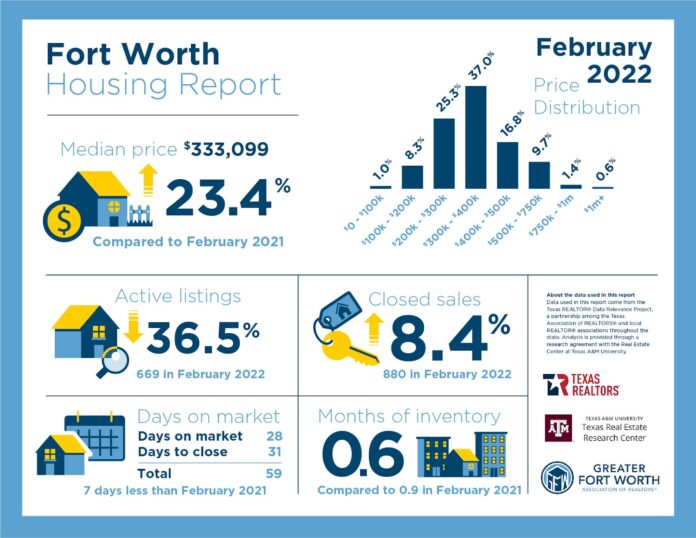

According to RE/MAX data, the supply of inventory in the Dallas-Fort Worth area fell to 0.7 months in February, down from 1.4 months a year earlier, a 50% drop. According to data from the Texas A&M Real Estate Research Center, Fort Worth had only 0.6 months or 18 days of inventory available in February, down from 0.9 months a year earlier. The Texas A&M Real Estate Center says that a 6 1/2 months of inventory represents supply and demand for homes being in balance. Fort Worth’s current housing inventory rate is a new record low, said Shannon Ashkinos, 2022 President of the Greater Fort Worth Association of Realtors and vice president of Connections & Career Success at JPAR Real Estate.

Nationwide, the number of homes for sale in February 2022 was down 6.8% from January 2022 and down 28.9% from February 2021, according to the RE/MAX survey. Inventory nationwide decreased to 1.2 months compared to 1.8 months in February 2021. The markets with the lowest inventory were Denver at 0.4, and a four-way tie between Albuquerque, Charlotte, Raleigh-Durham, and Seattle at 0.5, according to the RE/MAX survey.

“We have an intense buyer competition going on with an incredibly tight supply,” said Ashkinos, “As a result, home prices are still climbing. With the addition of inflation, it’s a difficult time for homebuyers, with things unlikely to improve in the market before April.”

The median price for a home in Fort Worth increased to $333.099 in February, up 23.4% from the same month a year earlier, according to Texas A&M Real Estate Center. Fort Worth is still below national median sales prices, according to the RE/MAX’s survey of 51 metropolitan areas in February. That survey shows the national median sales price was $345,000 up 17.3% from February 2021.

Those price increases in Fort Worth are starting to be felt in neighborhoods that had once been fairly immune to big increases, said Shelby Kimball, of Fort Worth Kimball Real Estate.

There may be a little bit of a slowdown in the number of home buyers, said Kimball.

“It’s not going to ease anytime quickly, but the mortgage rate is inching up,” he said. “So that is pricing a few more people out of buying a home right now.”

A recent announcement by the Federal Reserve about federal fund rate increases could lead to higher mortgage interest rates, said Clare Losey, assistant research economist with the Texas Real Estate Research Center.

“This is the first of what economists say could be as many as seven increases in 2022,” said Losey in a news release. “Such increases diminish purchase affordability, making it even harder for lower-income and first-time buyers to purchase a home.”

Ashkinos said mortgage interest rate increases could impact first-time buyers. Buyers who are switching homes or coming from out of state will probably have more cash to put down on a home than a first-time buyer, she said.

While the inventory of homes is currently low, there are developments coming on line that may help.

Scottsdale, Arizona-based Walton, a land asset management and global real estate investment company, in January announced a deal with Meritage Homes of Texas and Green Brick Partners for 118 acres and 430 home sites. The price range of the homes have not been announced.

“We’re way behind on building homes in this area,” Ashkinos said.”It’s going to be sometime before we can hope to catch up.”

Bob Francis is business editor for the Fort Worth Report. Contact him at bob.francis@fortworthreport.org. At the Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our editorial independence policy here.

This article was originally published by Fort Worth Report.