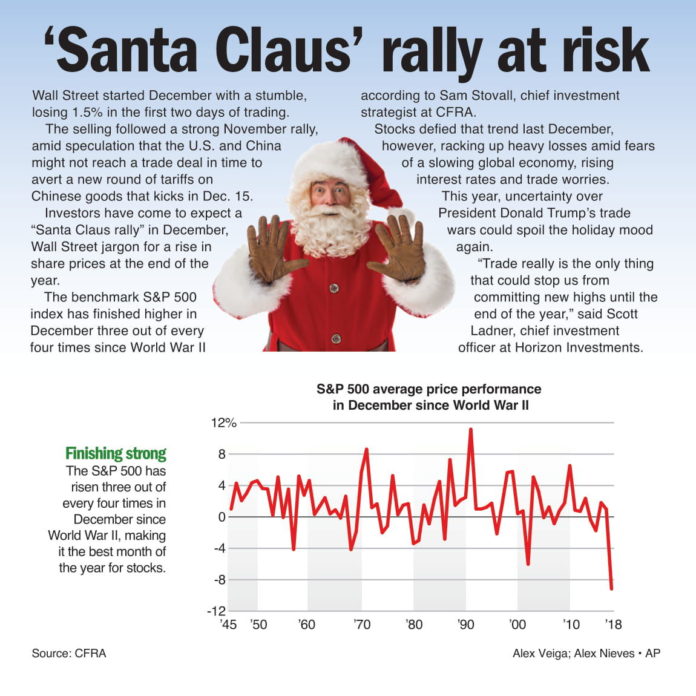

Wall Street started December with a stumble, losing 1.5% in the first two days of trading. The selling followed a strong November rally, amid speculation that the U.S. and China might not reach a trade deal in time to avert a new round of tariffs on Chinese goods that kicks in Dec. 15. Investors have come to expect a “Santa Claus rally” in December, Wall Street jargon for a rise in share prices at the end of the year. The benchmark S&P 500 index has finished higher in December three out of every four times since World War II according to Sam Stovall, chief investment strategist at CFRA.

Stocks defied that trend last December, however, racking up heavy losses amid fears of a slowing global economy, rising interest rates and trade worries. This year, uncertainty over President Donald Trump’s trade wars could spoil the holiday mood again. “Trade really is the only thing that could stop us from committing new highs until the end of the year,” said Scott Ladner, chief investment officer at Horizon Investments.