From Grand View Research Craft Spirits Market Report

• The global craft spirits market was valued at $6.13 billion in 2016 and is expected to grow at an impressive CAGR of 33.4 percent from 2017 to 2025, owing to growing consumer tastes and preferences towards unconventional and experimental alcoholic beverages

• Whiskey was the largest product segment of the global industry, owing to surging demand for flavored products formulated using ingredients such as whole spices and herbs

• Gin is anticipated to be the fastest-growing product segment of the market over the forecast period, owing to augmented use of the products in cocktails

As the craft-brewing craze continues to bring newcomers, the market is becoming more saturated and competitive. As a result, some wannabe brewmeisters have turned to craft distilling instead.

After all, distilling spirits involves the same initial steps as brewing beer.

But the smaller, younger craft distillery movement is much more than a stepsister of craft beer brewing. It has also attracted some passionate purveyors who want to produce high quality spirits that rival the finest around the world.

Among them is Rob Arnold, master distiller at Fort Worth’s Firestone & Robertson Distilling Co. Through his passion and dedication, he hopes to put Fort Worth and Texas on the map for spirit-making just as Napa Valley did for wine.

“I think we can get to the point one day when our whiskey becomes the best of the best when compared to Ireland, Kentucky and Scotland,” Arnold said. “In the 60s and 70s, no one was producing quality wine in Napa Valley.”

But that changed when vintners started paying closer attention to the science of growing grapes.

Arnold is applying the same approach to growing corn.

The Texas distilling industry has undergone an explosion in growth in the past few years but distillers are relying on commercially grown corn from the Midwest to produce their mash.

Arnold is involved in a project to grow new strains of corn with distinctive flavor that is cultivated to grow in Texas for whiskey production.

A Kentucky native, Arnold earned a bachelor’s degree in microbiology and then a master’s degree in biochemistry. He is now working on a Ph.D. from Texas A&M University under the tutelage of Seth Murray, a professor of soil and crop science.

Arnold’s doctoral research involves developing new strains from about 7,000 corn varieties. With the assistance of graduate students at Texas A&M, Arnold and Murray are growing test batches from cross-pollinations developed individually by hand.

“This is very unique and difficult,” Murray said. “Rob is a remarkable guy. Nobody’s done anything like this before.”

Besides this project, Arnold has taken other steps to produce a truly Texas product, including contracting with Hillsboro area farmers to grow rye and barley for the distillery. Both types of crop grow mostly in Northern states and Canada.

And after exhaustive research, he created a proprietary strain of yeast derived from local organic sources such as pecan nuts.

Arnold joined Firestone & Robertson before the distillery produced its first batch of blended whiskey in 2012. He has never been discouraged by challenges.

“You have to have higher goals if you want to compete with the best,” he said.

The distillery’s TX Whiskey has already won international acclaim and this product, along with its TX Straight Bourbon, have become popular favorites in the Texas distilling industry.

Arnold is co-author of Shots Of Knowledge: The Science Of Whiskey, which was published by TCU Press in 2016. His co-author is Texas Christian University Professor Eric Simanek.

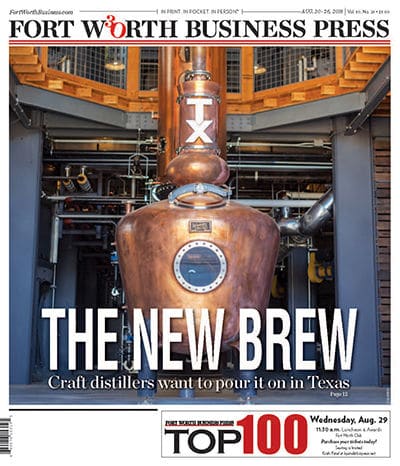

As one of the oldest whiskey distilleries in Texas, Firestone & Robertson also operates the largest whiskey distillery west of the Mississippi River at Whiskey Ranch on the site of the former Glen Garden Country Club. This new flagship distillery is the second location in Fort Worth.

Although the craft distilling industry is relatively new, Texas has one of the largest craft distilling operations in the country, according to the Texas Distilled Spirits Association, an industry trade group. Texas ranks behind California and Florida.

The current count of permits (active and inactive) for craft distilling plants statewide is 138, according to the Texas Alcoholic Beverage Commission. Twenty of those permits are for operations in North Texas, including five in Fort Worth.

By comparison, the Texas Craft Brewers Guild counted more than 200 breweries statewide for an economic impact of $4.5 billion in 2016, the latest year of available data.

The Texas Distilled Spirits Association has yet to conduct an economic impact study but the industry has created 46,733 jobs and paid $472 million in state and federal excise taxes in 2015, according to latest data. About 38 million nine-liter cases of spirits were sold that year, up from 32 million in 2013.

The industry has undergone rapid growth since 2010, when there were only 17 permits issued for distilling operations in Texas.

“We’ve come a long way in a short amount of the time but we are nowhere near the 1,800 distilleries that operated in the 1800s way before Prohibition,” said Mike Cameron, president of the Texas Distilled Spirits Association.

It wasn’t until the mid-1990s that the tireless efforts of Tito Beveridge found a loophole in state beverage laws, which opened the door to legal micro-distilling in Texas. Austin-based Tito’s Handmade Vodka is the oldest and largest craft distilling operation in Texas.

Now, all types of craft distilled products are produced in Texas, including gin, rum, single malt, liqueur and bitters in addition to whiskey, bourbon and vodka.

The largest concentration of craft distilling operations is in the Austin area but the movement has spread to all parts of the state, Cameron said.

“Craft distilling is something that appeals to serious enthusiasts with an entrepreneurial spirit because this is an industry with a lot of challenges,” said Carrie Simmons, lobbyist for the Texas Distilled Spirits Association.

Industry rules and standards for producing aged whiskey alone require a years-long maturation process, meaning that it takes years to get the product to a bottle, she said. A lot of distillers produce vodka or blended whiskies to create a revenue stream during the interim.

Beyond that are restrictive Texas laws that limit the number of bottles producers can sell from their distilleries. Distillers may sell only two bottles per person per month up to 3,500 annual gallons per year. They can also sell drinks onsite from their tasting rooms.

Texas’ restrictive three-tier regulatory system gives craft distillers an edge over craft beer brewers, who can’t sell any packaged products to go from their breweries. But the law prevents package liquor sales in grocery or convenience stores, unlike beer and wine.

“The alcoholic beverage industry is the most heavily regulated and taxed in the state but we’re working to change that,” Simmons said.

Introduced during previous sessions of the Legislature was a bill that would increase the number of bottles to six per customer per month still within the 3,500 gallons per year limit. Other bills would have allowed distilleries to offer tastings at package liquor stores, bars and restaurants and apply for permits to sell their products at festivals.

During next year’s session of the Texas Legislature, the distillers’ organization will again push for increasing the limit on bottle sales at distilleries, lifting the prohibition on shipping bottles and allowing permits for festival sales, Simmons said.

One of the biggest challenges hamstringing distillers’ agenda is the limitation of package sales at grocery and convenience stores, she said.

“The only place you can buy these products is in a liquor store,” Simmons said. “You see all these products lined up on a shelf and it’s hard to distinguish one from another that way.”

As a result, distillers have to work hard at marketing and distinguishing their products, she said.

Firestone & Robertson does that with its unique and Texas grown ingredients as well as using its resplendent Whiskey Ranch for tours, enjoying drinks and events.

Cameron, co-founder of Rebecca Creek Distillery in San Antonio, has found a niche for his new Devils River Whiskey distillery by drawing water from the Devils River in Southwest Texas. The river flows underground for about 20 miles through limestone beds, which gives it a clean, distinctive taste.

“It’s the purest water in Texas,” he said.

Acre Distilling in downtown Fort Worth is an operation that was originally intended as a brewery but instead became a distillery because of oversaturation of the brewery market, according to sales director Kyle Bush.

Acre owner Tony Formby had been a part owner of Fort Worth’s craft beer stalwart, Rahr and Sons, and wanted to continue the brewing tradition until his compatriot, brewer J.B. Flowers, suggested going in the other direction, Bush said.

Acre is located in a historic downtown building in what was once Fort Worth’s red-light district known as Hell’s Half-Acre.

The historic building, unique tasting room design and a menu of 15 products, including flavor-induced vodka and single barrel bourbon whiskey, are what helps set it apart in the growing Texas spirits industry, Bush said.

“We do everything we can to make our distillery and our products unique and memorable,” Bush said.