(Bloomberg) — U.S. stocks rose, while oil climbed the most in two months, on the final day of a week in which global growth concerns resurfaced and currency volatility jumped.

The Standard & Poor’s 500 index ended higher after erasing almost all of an advance in afternoon trading as biotechnology companies and retailers weighed on the measure. Energy shares jumped as oil topped $39 a barrel ahead of a meeting between suppliers to discuss freezing production. The yen and gold were little changed as the demand for haven assets eased. Canada’s dollar surged after employers added more jobs in March than economists forecast.

Stocks swung between gains and losses this week as the yen surged to a 17-month high versus the dollar. While minutes from the Federal Reserve’s March meeting reaffirmed a gradual approach to raising interest rates, concern mounted over a slowing world economy. Investors are awaiting fresh cues with China due to publish a raft of economic indicators next week and Alcoa Inc. kicks off the U.S. earnings season with first-quarter results on April 11.

“It’s been up and down every day, but it no longer feels like the short squeeze panic buying we had at the end of the quarter,” Brian Frank, portfolio manager at Frank Capital Partners LLC, said by phone. “Commodities aren’t leading the band like they were at the beginning of the year, but they are definitely playing a role.”

– – –

The S&P 500 rose 0.3 percent at 4 p.m. New York time, with the gauge little changed for the year. Lenders in the benchmark measure recovered after being the biggest drag yesterday amid concern lower-for-longer interest rates will crimp profits.

Biotechnology companies posted some of the biggest losses today, with Regeneron Pharmaceuticals Inc. and Endo International Plc declining. Gap Inc. shares tumbled as much as 15 percent after the struggling apparel chain posted disappointing sales and said that inventory is piling up.

The S&P 500 dropped 1.2 percent in the week ahead of what is forecast to be the worst earnings season since the financial crisis. Analysts estimate profits fell 9.5 percent in the first quarter.

Commodity producers and banks led the rebound in the Stoxx Europe 600 index, up 1.2 percent. Europe’s equities trimmed a fourth weekly drop, the longest losing streak since October 2014.

– – –

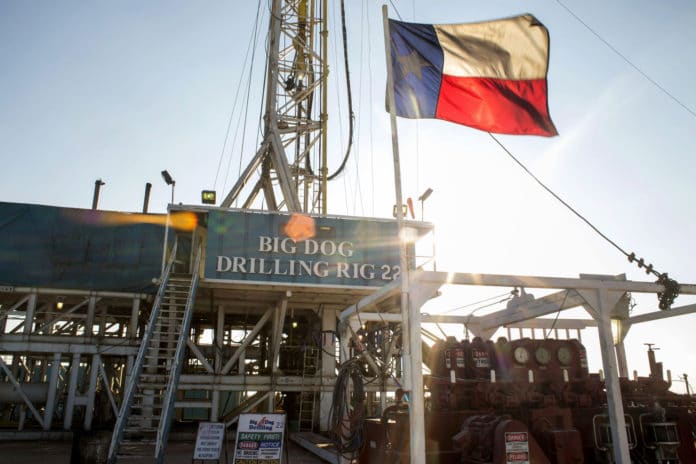

West Texas Intermediate crude rallied 6.6 percent to $39.72 a barrel, the biggest jump since Feb. 12. Speculation has returned that Russia and OPEC members can reach a deal on freezing oil output when they meet in Doha on April 17. Saudi Arabia has said it will only agree if it’s joined by other suppliers including Iran, while Kuwait said a deal can be done without Iran’s support. An unexpected drop in U.S. crude inventories in data out this week also helped crude’s recovery.

Spot gold was little changed, as it posted a second week of gains. The precious metal posted its best quarterly gain in three decades through March as worries about global growth and market turmoil prompted the Fed to delay further rises in borrowing costs.

Natural gas for May delivery wiped out an advance to retreat 1.5 percent, trimming a second week of gains. A storm that was forecast to bring snow to New York has shifted south, reducing the outlook for heating demand.

– – –

The yen was little changed at 108.16 per dollar after surging to 107.67 last session, its strongest level since October 2014. Despite Friday’s pullback, the currency is still up more than 3.2 percent this week as the Fed’s dovish approach to U.S. interest-rate policy weighs on the greenback and traders speculate that Japanese officials are reluctant to intervene in the market.

A JPMorgan Chase & Co. index measuring price swings in Group-of-Seven currencies rose for the five days through Thursday to just below its highest level since December 2011. It climbed above a gauge for emerging-market currencies for the first time since August.

The loonie, as the Canadian dollar is known for the image of the aquatic bird on the C$1 coin, gained 1.1 percent to C$1.3001 per U.S. dollar after Statistics Canada reported that employment increased by 40,600 in March after falling 2,300 the previous month.

– – –

The yield on U.S. 10-year Treasuries added three basis points to 1.72 percent, paring this week’s decline to five basis points. U.S. debt has advanced along with other haven assets amid renewed concern that easy monetary policies haven’t boosted global growth.

“We are seeing central bank fatigue,” Niv Dagan, executive director at Peak Asset Management LLC in Melbourne, said by phone. “We’re definitely moving to a risk-off scenario and there’s been a strong flight to safety. Investors are cautious and are extremely nervous that global central bank intervention won’t actually stimulate growth in the economy.”

The yield on Spanish 10-year bonds fell eight basis points to 1.51 percent. The securities fell for six days through Thursday, the longest run since a nine-day losing streak through July 24, 2012. That was two days before European Central Bank President Mario Draghi’s pledge to do “whatever it takes” to preserve the euro. Italian and Portuguese bonds also rose.

– – –

Gains in energy producers lifted the MSCI Emerging Markets index up 1 percent. The gauge is still down 1.1 percent this week. Benchmarks for Brazil, Russia, Turkey and Thailand and Taiwan gained.

The Hang Seng China Enterprises index of mainland shares traded in Hong Kong rose 0.7 percent, paring its weekly decline to 1.6 percent. The Shanghai Composite index dropped 0.8 percent on Friday, capping its first weekly loss in a month. Data on Monday will probably show the consumer-price index climbed to 2.4 percent in March, according to a Bloomberg survey.

The MSCI Emerging Markets Currency index added 0.4 percent, trimming this week’s drop to 0.2 percent. Russia’s ruble, South Africa’s rand and Brazil’s real led gains on Friday, advancing at least 1.3 percent. In the five-day period, the real slid 1.3 percent, among the worst performers out of 24 developing-nation currencies.

– – –

With assistance from Adam Haigh, Candice Zachariahs, Cecile Vannucci, David Goodman, Eddie van der Walt, Sofia Horta e Costa, Emma O’Brien and Stephen Kirkland.