HOUSTON — Refiners are poised to make gasoline at a record pace this year, keeping the biggest U.S. crude glut in more than 80 years from overflowing storage.

They’re enjoying the best margins in two years as they finish seasonal maintenance of their plants before the summer driving season. They’ll increase output to meet consumer demand and they’ve added more than 100,000 barrels a day of capacity since last summer, when they processed the most oil on record.

Booming crude production expanded inventories this year by 86 million barrels to 471 million, the highest level since 1930. Analysts from Bank of America to Goldman Sachs have said storage space may run out. What looks like an oversupply to banks is turning into an all-you-can-eat buffet for those making gasoline and diesel fuel.

“A lot of the excess crude we’ve been sitting on is going to get chewed up quickly,” Sam Davis, an analyst for energy consulting company Wood Mackenzie, said in Houston April 2. “We’re going to move from a stock build to a stock draw.”

Goldman Sachs and Bank of America have said storage builds are increasing the risk of breaching storage capacity, sending prices tumbling. West Texas Intermediate oil, the U.S. benchmark, already has lost more than half its value since June as growing U.S. shale production led to a global oversupply.

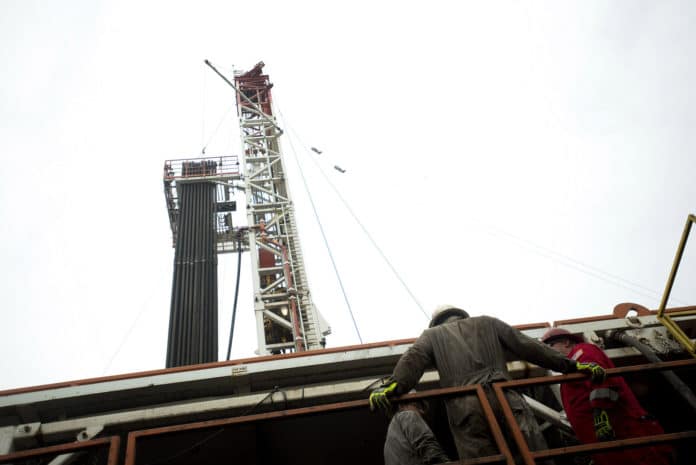

Inventories surged as U.S. output rose 71 percent over the past five years as drillers used techniques like horizontal drilling and hydraulic fracturing to tap previously inaccessible oil in shale rock layers. In Cushing, Oklahoma, the delivery point for WTI futures, supplies have more than tripled since early October to a record 58.9 million barrels.

Last July, refiners processed 16.5 million barrels of crude a day, the highest level in monthly Energy Department data going back to 1961. Refining margins in March have averaged $28.09 a barrel, the most since March 2013.

Refiners typically schedule maintenance shutdowns in the spring and fall, reducing oil demand during that time. U.S. refiners increased crude runs by an average 1.1 million barrels a day in April through July over the past five years. During that period, U.S. crude inventories have fallen an average of 24.7 million barrels from the end of May through September.

Companies like Enterprise Products Partners and TransCanada have increased pipeline capacity from Cushing to the Gulf Coast to more than 1.5 million barrels a day from nothing at the beginning of 2012.

Shippers may use more of that space in April after differentials between crudes on the Gulf Coast and Cushing widened to the highest level since January 2014.

Light Louisiana Sweet averaged a $6.60 premium to WTI in March, according to data compiled by Bloomberg. Uncommitted shippers would have to pay between $5.11 and $6.58 a barrel to ship on pipelines from Cushing to St. James, Louisiana, where LLS is priced, according to regulatory filings.

Higher refinery runs and pipeline flows might not be enough to reduce inventories in Cushing, said Andy Lipow, president of Lipow Oil Associates in Houston. WTI is in a contango market structure, with futures contracts for April 2016 selling for $10.84 a barrel more than April 2015 when that contract expired on March 20. That encourages traders to keep crude in Cushing to profit on the trade, Lipow said.

“There’s an incentive to fill up Cushing and hold it there,” he said.

Kinder Morgan planned to run its 50,000-barrel-a-day Houston splitter at full rates by the end of March, company spokeswoman Melissa Ruiz said last month. Another unit of the same size is scheduled to come online later this summer. A splitter processes an ultra-light form of crude known as condensate that is plentiful in shale regions.

Delek US Holdings and Marathon Petroleum are expanding the capacity of refineries to run domestic crude. MDU Resources and Calumet Specialty Products Partners plan to start up a new 20,000-barrel-a-day refinery in North Dakota in the second quarter.

“There are a few incremental expansions that are going to help out and everyone else should be running full out, margins are saying to do that,” said John Auers, executive vice president at Dallas-based energy consultant Turner Mason & Co. “That will help drain Cushing.”