OPEC nations have agreed in theory that they need to reduce their production to help boost global oil prices during a meeting in Algeria this week, but a major disagreement between regional rivals Saudi Arabia and Iran still may derail any cut. If ratified in November, an OPEC production cut wouldn’t stop members from ignoring their quotas and pumping whatever they can. It’s happened many times before.

But if it sticks, it could be good news for Texas and, in particular, shale producers. Any price rise in oil also could entice U.S. shale producers, whose break-even production costs are often higher than OPEC countries’, back into the market.

OPEC’s moves may be coming at the right time. According to a report released Sept. 28 by the Federal Reserve Bank of Dallas, oil and gas companies in Texas have stepped up activity in the third quarter as they gain more confidence in recent oil and gas price stability.

The business activity index—the survey’s broadest measure of sentiment among Eleventh District energy firms—strengthened to 26.7 from 13.8 in the second quarter. Positive readings in the survey generally indicate expansion, while readings below zero generally indicate contraction.

“Overall, conditions in the oil and gas sector continued to improve in the third quarter,” said Dallas Fed senior economist Michael D. Plante. “With that being said, signs of the slump still remain visible as employment indicators remained soft, and respondents expressed concerns about continued oversupply in the oil market.”

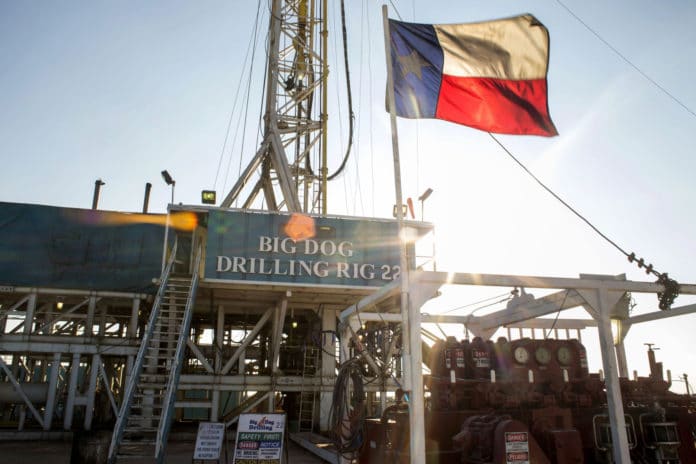

With oil prices now hovering in the $40 to $50 range, even the Texas energy sector has shown some signs of improvement. The rig count reached 244 for the week ending Sept. 16—up from its May low of 173. In a further sign of strength, Houston, which has been hard hit by the bust, saw employment gains in August.

Dallas Fed officials say the job growth are heartening for the Texas – and energy – economy.

“We saw increased job growth in the service sector, we saw a decline in the pace of losses in the goods-producing sector, and most remarkably, we saw an increase in oil and gas employment in August that we hadn’t seen since 2014,” said Pia Orrenius, a Fed economist.

Business activity index samples oil and gas companies headquartered in the Eleventh Federal Reserve District—Texas, southern New Mexico and northern Louisiana—many of which have national and global operations.

Oil and gas (O&G) support services firms reported that equipment use increased in the third quarter, driving the equipment utilization index up 25 points, and out of negative territory, to 24.1.

Outlooks six months out improved, with the index coming in at 19.6, similar to 19.0 last quarter. The company outlook index for E&P firms came in at 29.5, compared with 11.2 for support service firms. Respondents continue to be bullish about oil and natural gas prices one-year ahead. Almost 62 percent believe oil prices will be higher than they currently are, and 48 percent believe natural gas prices will increase.

Respondents were also asked about drilling activity for oil and gas in the U.S. next year and beyond.

There was near unanimity that the price of West Texas Intermediate will need to be at or above $50 per barrel to see a substantial increase in drilling for oil, and over 90 percent think it will need to be $55 per barrel or more. Over 70 percent of respondents think U.S. crude oil drilling activity will substantially increase sometime before 2018, with the most frequent response being second quarter 2017.

Following OPEC’s actions, benchmark U.S. crude rose 35 cents to $48.17 per barrel in New York. Brent crude, the international benchmark, picked up 29 cents to $50.10 a barrel in London.

Around 46 percent of respondents expect U.S. natural gas production to be about the same in 2017 as in 2016, 35 percent expect higher production, and 20 percent expect lower production. Appalachia was seen as the most likely location for natural gas drilling activity to increase in 2017. The average expected Henry Hub natural gas price in 2017 was $3.00 per million British thermal units (MMBtu).

While Texas – and U.S.-based – shale producers may benefit from OPEC push for higher prices, it will depend on whether the accord leads to a lasting increase in prices. One of Saudi Arabia’s objectives over the past years was to push the U.S. shale industry, with its once-booming production but high costs, out of business. That’s been partly achieved, with thousands of wells now idled. “We may not get the uplift that U.S. shale is expecting,” Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas in London, told Bloomberg Radio.