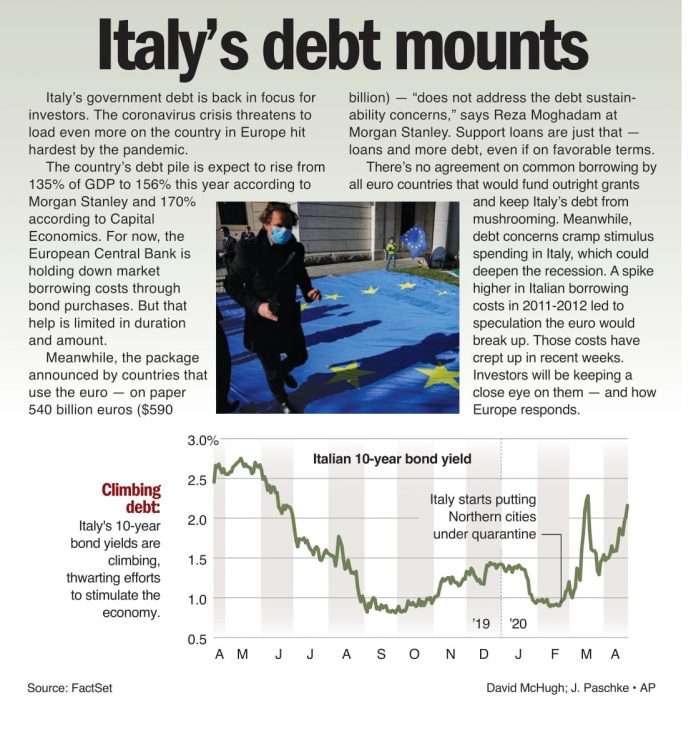

Italy’s government debt is back in focus for investors. The coronavirus crisis threatens to load even more on the country in Europe hit hardest by the pandemic. The country’s debt pile is expect to rise from 135% of GDP to 156% this year according to Morgan Stanley and 170% according to Capital Economics. For now, the European Central Bank is holding down market borrowing costs through bond purchases. But that help is limited in duration and amount. Meanwhile, the package announced by countries that use the euro — on paper 540 billion euros ($590

billion) — “does not address the debt sustainability concerns,” says Reza Moghadam at Morgan Stanley. Support loans are just that — loans and more debt, even if on favorable terms. There’s no agreement on common borrowing by all euro countries that would fund outright grants and keep Italy’s debt from mushrooming. Meanwhile, debt concerns cramp stimulus spending in Italy, which could deepen the recession. A spike higher in Italian borrowing costs in 2011-2012 led to speculation the euro would break up. Those costs have crept up in recent weeks. Investors will be keeping a close eye on them — and how Europe responds.