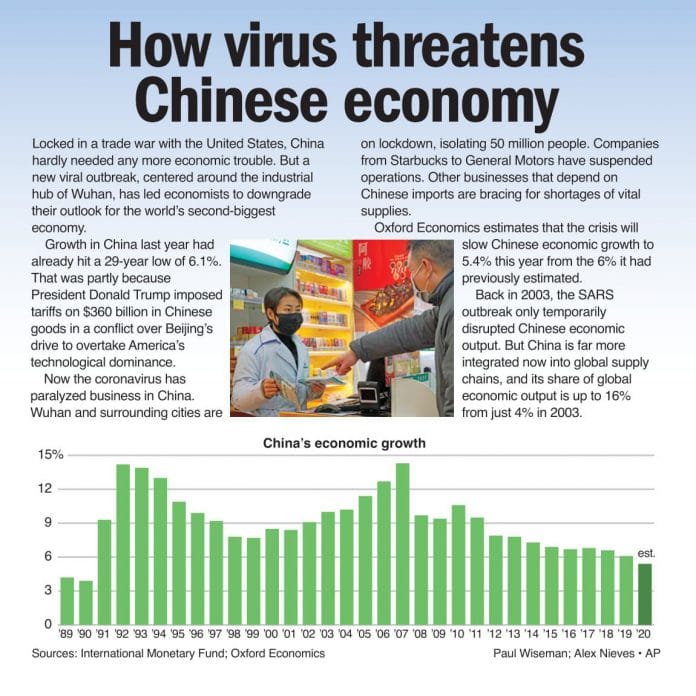

Locked in a trade war with the United States, China hardly needed any more economic trouble. But a new viral outbreak, centered around the industrial hub of Wuhan, has led economists to downgrade their outlook for the world’s second-biggest economy. Growth in China last year had already hit a 29-year low of 6.1%. That was partly because President Donald Trump imposed tariffs on $360 billion in Chinese goods in a conflict over Beijing’s drive to overtake America’s technological dominance. Now the coronavirus has paralyzed business in China. Wuhan and surrounding cities are on lockdown, isolating 50 million people.

Companies from Starbucks to General Motors have suspended operations. Other businesses that depend on Chinese imports are bracing for shortages of vital supplies. Oxford Economics estimates that the crisis will slow Chinese economic growth to 5.4% this year from the 6% it had previously estimated. Back in 2003, the SARS outbreak only temporarily disrupted Chinese economic output. But China is far more integrated now into global supply chains, and its share of global economic output is up