Open enrollment for the insurance exchanges created by the Affordable Care Act kicks off Tuesday and there’s a good chance consumers logging on to compare plans will face some sticker shock.

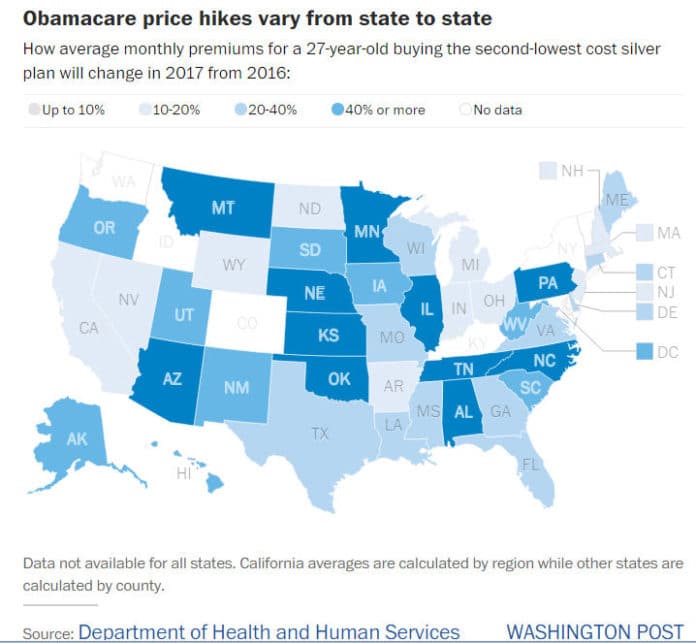

Monthly insurance premiums for popular plans on HealthCare.gov are rising by 25 percent on average next year, according to government data. But the increases will be more dramatic in certain parts of the country, the numbers show.

Take somebody living in Phoenix, where the cost of the premium for a benchmark plan is growing by a whopping 145 percent to $507 a month in 2017 when compared to this year, according to an analysis by the Kaiser Family Foundation, which tracks how premiums are changing in some major cities.

In Birmingham, Alabama, health care premiums for a similar plan are climbing by 71 percent next year to $492 a month. And in Oklahoma City they are growing by 67 percent.

The report focuses on the cost of the second most affordable plan in the “silver” tier of coverage, which is used to determine the size of the federal subsidy consumers can receive to lower their monthly premium costs. Plans in the lower “bronze” level are less expensive but cover a smaller percentage of total health costs. Plans in the higher level cost more but cover a bigger share of health costs.

The increases will be more moderate in some cities. For example, monthly premium costs in the District of Columbia will grow by 22 percent next year. In Baltimore they are growing by 24 percent, in line with the national average. And in some cities, premiums are actually falling from what they were this year. For example, premiums are dropping slightly in Providence, Rhode Island; Cleveland and Indianapolis.

There are lots of factors contributing to the price changes. Premiums are going up in some areas because insurance companies are dropping out of the market, leaving consumers with fewer options. Some insurance companies are raising rates because the premiums they charged initially were too low to cover the costs they faced, causing them to lose money, says Cynthia Cox, associate director of health reform and private insurance for the Kaiser Family Foundation.

Premium increases might be even larger in rural areas not featured in the report, which highlighted a major city in each state, said Cox. Consumers there tend to have fewer options for coverage, since it can be more expensive for insurers to offer plans in markets with smaller populations and fewer choices for health-care providers, she said.

The takeaway for consumers is to shop around and compare plans during open enrollment season, which ends on Jan. 31, 2017. About 13.8 million people are expected to choose insurance plans through the exchanges during this enrollment period, according to estimates from the Department of Health and Human Services. (People buying insurance through their jobs, which make up the majority of the workforce, are not affected and will have a separate open enrollment period soon through their employers.)

The majority of people buying insurance through the exchanges, 85 percent, receive subsidies that help them soften the blow of the price increases, according to HHS. Some consumers can receive bigger subsidies – and keep their monthly premium costs the same – if they choose the second most affordable silver plan in their market.

For example, the premium for the second-lowest cost silver plan in the District is growing by $54. People who choose that plan and receive subsidies won’t see any change in what they have to pay each month if their income and family situation stays the same. Their monthly subsidies, however, would grow to $91 next year from $36 this year, according to the Kaiser Family Foundation.

Still, some consumers may need to change plans to avoid a higher bill if their plan becomes more expensive or if the size of their subsidies change. But the decision shouldn’t be based on the premium alone. Consumers should factor in how other out-of-pocket costs, such as what they have to pay for medication or for doctor’s visits, might change with the new plan. Families should look into whether the doctors they need would be included in the plan they’re considering, Cox says.