Life insurance, like taxes, may not be considered the most thrilling thing around, but one Fort Worth insurance company has seen its share of excitement – and firsts – over the years.

Don Woodard Sr. didn’t set out to blaze any trails in the industry. The 89-year-old Fort Worth native is as well known today for his acerbic wit, gatherings of friends at Colonial Country Club, letters to the editor and political activism – he ran for state Senate in 1964 and for mayor of Fort Worth in 1982.

When Woodard got out of the U.S. Navy after World War II, he worked in the oil business in the late 1940s and 1950s as an assistant to oilman Neville G. Penrose and later as a landman with Texas Pacific Coal and Oil Co. He became an executive assistant at Texas Electric Service Co. and then began a career as an agent with Southwestern Life Insurance Co. of Dallas. In 1972, he established Don Woodard Insurance Co.

“I just wanted to shoot for higher things,” he said. “Insurance is the only business you can go and get paid for your abilities and you only get paid for what you do. You go out and make a sale, you get a commission. I knocked on doors all over this town, from the highest to the lowest. In the end, in the insurance business, you get what you are worth – not a dollar less, not a dollar more. It’s all up to you. If I’m a millionaire, I’ve earned it. If I’m a pauper, I’m a pauper.”

In July 1986, Don Sr. and his sons, Don Jr. and Blake, formed a pioneering life insurance partnership called Woodard Insurance. Don Jr. had been a career agent with Southwestern Life since 1981, and Blake had just graduated from Texas Christian University with a finance degree.

At that time, life insurance partnerships were a revolutionary idea.

“Starting a partnership’s not hard but there was no license for a partnership allowed by the state of Texas,” said Blake, now 50. “You could either do business as individuals or you could form a corporation. That was it.”

Enlisting the help of then-state Sen. Mike Moncrief, the Woodards lobbied the Legislature and the commissioner of insurance (now the Texas Department of Insurance) to allow life insurance partnerships to be licensed.

Woodard Insurance LLP, the state’s first and oldest licensed life insurance partnership, was born.

The family-owned business faced a similar issue in the 1990s, when it wanted to sell HMO insurance to employers but state law made no provision for partnerships like Woodard Insurance to handle such policies. Moncrief’s office intervened with the state insurance department to help the company get the license it needed.

CHANGES AND CHALLENGES

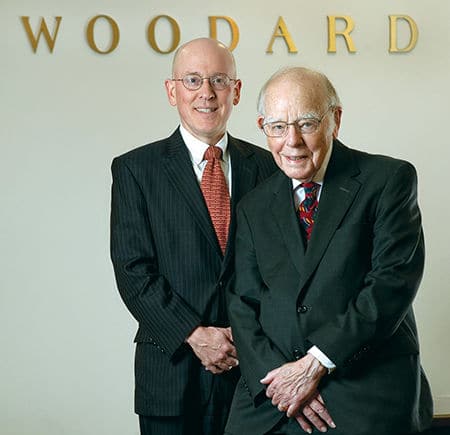

Blake bought out his brother’s interest in the firm in January 2001. Today, he and his father are partners, handling life insurance, disability insurance and long-term care insurance planning, with an emphasis on planning for physicians. Woodard serves more doctors than any other insurance firm in Tarrant County.

“Blake is the brains behind all of this,” said his dad, who still comes into the office every day. “I’m so proud of Blake. When he got out of TCU summa cum laude, he had all kind of offers to come to work. But he said he was going to stay with his dad and he did. He has built this into what it is.”

Father and son have seen numerous changes in the insurance industry over the past 30 years, from new technology and the introduction of guaranteed products to compliance with ever-evolving federal and state regulations and laws. The Affordable Care Act, or Obamacare, has been the single most significant change in business for Woodard Insurance, according to Blake.

“First there was COBRA in 1986 and then HIPAA, which has been amended a number of times. But nothing like Obamacare,” he said.

Blake was actually in Washington, D.C., the day the House passed the Affordable Care Act by one vote.

“I saw Obama driving from the White House to the Capitol to pressure the House Democrats to get that last vote. I was there,” he said.

Blake says that “Obamacare has added to my daily reading requirement an hour a day and that’s for five years. The whole focus of health insurance planning for corporations has changed. It’s not insurance, it’s compliance. You’d better be very knowledgeable about the laws. Your clients expect you to know all of this. No one knows it all.”

Keeping up with changing laws and regulations is a constant challenge, he added, but life insurance sales are strong.

“Life insurance rates have come way down since I started. People are living longer. The economy is doing well. Insurance rates are low,” he said. “Life insurance is the greatest bargain of all insurance. Most people don’t have life insurance or only what they get through their work. We have more people calling to get life insurance than we have time to process.”

One of the biggest challenges facing the insurance business today, according to Blake, is the dearth of people entering the profession.

“We need more young people coming into our business. Schools don’t promote insurance. Insurance it’s sexy. Most agents are independent but it’s an aging workforce,” he said.

“I can’t think of anything else I’d rather be doing than life insurance planning,” he added. “It’s a lot of fun to help people. The most rewarding part is when you’re helping a family at the end of life, handing over a payment and knowing that family’s going to be fine.”

WOODARD INSURANCE

1300 S. University Dr., Suite 600

Fort Worth 76107

817-877-4405