Trillions and trillions of dollars are being tossed around at the federal level like candy. We used to be shocked at talk of a billion dollars, then tens of billions, and hundreds of billions. Now it seems that we are regularly dealing in trillions of dollars.

So, how much is a TRILLION dollars? To begin with, the number has TWELVE zeroes. It’s a million millions. Google this and shock yourself: How many years is one trillion seconds? The answer: 31,709.29 years.

If we paid a $1 trillion debt in $100 bills, the cash would stack 631 miles high – that’s 2.5 times the distance to the International Space Station.

So, let’s agree that $1 trillion is a lot of money. Beyond the $1.9 trillion COVID relief bill, our current administration wants to pass an additional $4 trillion “infrastructure package” that goes far beyond infrastructure.

My position as chairman of the Small Business Council of the United States Chamber of Commerce provides me with access to a wealth of information that the average individual would need to invest substantial time to conduct research. The amount of data is overwhelming.

I admire the role that the Small Business Council and the U.S. Chamber of Commerce play in representing the interests of small business. Some of our recent advocacy has consisted of:

- Passing the Economic Aid Act stimulus legislation in December [2020]: This legislation opened Payroll Protection Program (PPP) funding for 501(c)(6) organizations that include local and state chambers of commerce and expanded COVID-19 emergency tax benefits. This legislation provided direct grants to these chambers of commerce, which are viewed as the “voice of business” for their local communities.

- Working with SBA administrators throughout the pandemic: Regularly acting as a direct contact with senior SBA leadership to troubleshoot challenges encountered by small businesses regarding their eligibility for PPP and Economic Injury Disaster Loans (EIDL).

- Continually reviewing the impact that any proposed legislation will have upon the entire spectrum of small businesses: No matter how well intentioned that action may be, unintended consequences still create disruption, so all proposed legislation must be completely reviewed and considered in its earliest stages.

- Distributing millions of dollars in grants to small businesses: These grantsthrough the U.S. Chamber of Commerce Foundation’s #SaveSmallBusiness Fund have helped provide a lifeline for small businesses.

Regarding specific legislation, the U.S. Chamber of Commerce has taken action that I support on four specific pieces of legislation:

- Opposed the $15 minimum wage: We do not feel that congressional leaders recognize that economies differ across the nation. For example, $100 buys a lot more in Muleshoe, Texas, than in Southlake, Texas. In North Dakota, where I graduated from college, the economy is entirely different in Minot than in Fargo. Legislators fail to understand the fallacy in the “one-size-fits-all” model, and they fail to consider what I call the “trickle-up” impact. Once low-wage employees move from $8/hour to $15, all those employees currently at $15/hour, due to higher skill sets, will demand increases in pay to separate themselves from the low-skill employees now earning $15/hour.

- Came out to recommend a sunset that would end the additional federal unemployment benefits early: Businesses such as mine – I currently have around 10 openings for good-paying jobs – are operating below maximum productivity. In this sense, small businesses are competing with the federal government for the labor force. A recent jobs report was lackluster at best, which led the National Federation of Independent Business (NFIB) to reveal its latest study that showed a record 44% of small businesses have job openings.

- Took a stand against the Protecting the Right to Organize Act (PRO): Four of the main points that concerned the U.S. Chamber were that this legislation would:

– Nationalize California’s reclassification of independent contractors so that companies would treat these contractors as employees, complete with employee benefits

– Institute a “card check” unionization system that would eliminate a private ballot and force voting to take place in a potentially intimidating atmosphere

– Allow boycotts of non-union businesses

– Eliminate the distinction between franchisors and franchisees, thus allowing trial lawyers to target national brands while removing the independence of franchisees

- Supported the Main Street Certainty Act: This legislation would make the 20% small business tax deduction permanent after it expires following 2025

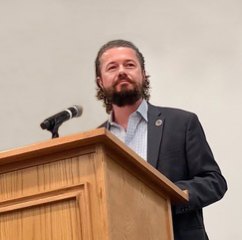

Ian MacLean is owner of Highland Landscaping Construction in Southlake. He was chosen to chair the Small Business Council of the United States Chamber of Commerce this past November. In this capacity, Ian speaks as “the Voice of Small Business in America.”