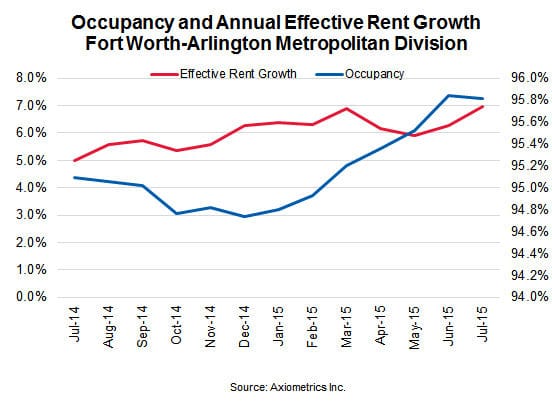

The Fort Worth-Arlington area retained its 95.8 percent apartment occupancy rate in July, the same as in June, according to Axiometrics, a Dallas-based apartment market research and analysis firm.

“While unit deliveries fo 2015 are up significantly from 2014, both metros [Fort Worth-Arlington and Dallas-Plano-Irving metropolitan divisions] have been able to absorb the deliveries well while maintaining occupancy above 95 percent and increasing rent growth, substantially, in both metros,” said Stephanie McCleskey, Axiometrics’ vice president of research, commenting in a news release.

The Fort Worth area’s 95.8 percent July occupancy was 3 basis points less from June. The rate was 72 basis points higher than the 95.1 percent reported in July 2014. A basis point is a unit equal to one hundredth of a percentage point.

Meanwhile, the Fort Worth area’s annual effective rent growth in July totaled 7 percent, about 68 basis points higher than June’s 6.3 percent and 194 basis points above the 5 percent reported in July 2014.

On average, Fort Worth-area renters paid $950 per unit in July.

Meanwhile, the Dallas area’s occupancy rate remained flat at 95.5 percent month over month, though up 68 basis points from July 2014’s 94.8 percent.

On average, Dallas renters paid $1,062 per unit.

But both Fort Worth and Dallas areas expect more apartments to hit the market this year, with Fort Worth expected to receive 3,144 new units, more than the 1,821 units delivered in the previous year. And Dallas anticipates 15,707 units this year, up from the 11,879 units delivered in 2014.

The two Fort Worth submarkets with the highest effective rent growth – Hurst/Bedford/Euless and I-820 – are receiving little, if any, supply, according to Axiometrics.

In the Dallas area, most growth continues to occur in the Oaklawn submarket, better known as Uptown. The area has been receiving the highest number of units for the past two years. In July 2014, the submarket’s 1.5 percent annual effective rent growth resulted from new supply. A year later, the submarket experienced a major comeback, with rent growth at 3.1 percent, while additional units were delivered to the submarket.