D.R. Horton Inc.’s proposal to purchase Forestar Group Inc. may be finding receptive ears.

D.R. Horton announced June 13 it has entered into a confidentiality agreement with Forestar Group Inc. under which both companies have agreed to exchange information and hold in discussions related to the previously announced Horton proposal to acquire 75 percent of the outstanding shares of Forestar common stock for $16.25 per share in cash.

Forestar previously announced that it had entered into a merger agreement with Starwood Capital Group on April 13, 2017 with Starwood would acquire all of the outstanding shares of Forestar common stock for $14.25 per share in cash, or a total of approximately $605 million. Forestar is still subject to the Starwood agreement.

Still, last week, Austin based Forestar said Horton’s offer could be superior to the Starwood offer.

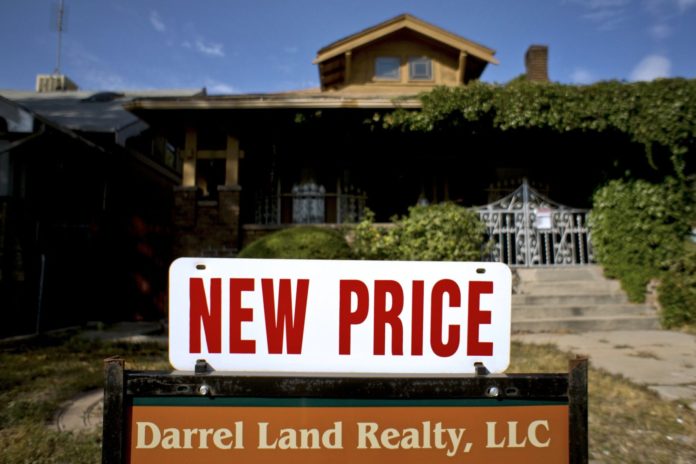

Analysts say Fort Worth-based Horton wants to acquire Forestar, a land development company, because land acquisition costs are rising as the housing market continues its momentum.

JMP Securities LLC is acting as financial advisor to Forestar and Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal advisor.