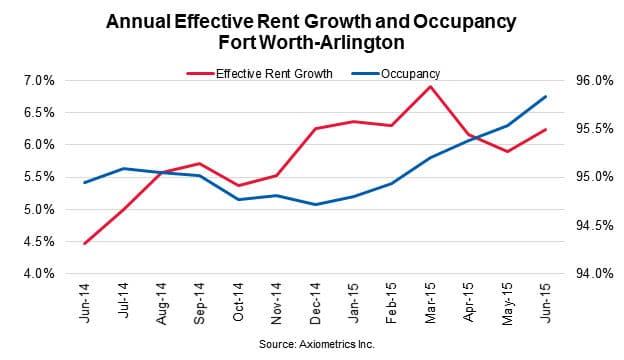

The Fort Worth-Arlington area reached 95.8 percent apartment occupancy in June, up slightly from 95.5 percent in May, according to Axiometrics, a Dallas-based apartment market research and analysis firm.

For the month, the Fort Worth and Dallas areas’ annual effective rent growth and occupancy levels trended above those of national averages, according to Axiometrics. And employment continued to be the primary factor.

“There is absolutely no doubt in our minds that the main driver of all of this supply is jobs,” said Stephanie McCleskey, Axiometrics’ vice president of research, commenting in a news release.

Fort Worth’ annual job growth rate surged by 20 basis points in May, while the Dallas metro area saw a 20-basis-point decline. A basis point is a unit equal to one hundredth of a percentage point.

“As long as the Metroplex continues generating jobs, developers will continue building apartment properties, and the markets will continue to absorb those new units,” McCleskey said.

The Fort Worth area’s 95.8 percent May occupancy was 30 basis points more than May’s 95.5 percent and 90 basis points more than the 94.9 percent figure in June 2014. The annual effective rent growth was 34 basis points more than May’s 5.9 percent and 197 basis points more than the 4.4 percent in June 2014.

On average, Fort Worth-area renters paid $938 per unit in June.

The June annual effective rent growth for Fort Worth-Arlington and Dallas-Plano-Irving regions totaled 6.2 percent and 6.4 percent, respectively. Nationally, annual effective rent growth totaled 5.1 percent, with occupancy at 95.3 percent.

Meanwhile, the Dallas area’s occupancy rate remained flat at 95.5 percent month over month, yet was 60 basis points more than June 2014’s 94.9 percent. The area’s occupancy rate also trended higher than the national occupancy rate of 95.3 percent.

On average, Dallas renters paid $1,052 per unit.

But both Fort Worth and Dallas metro areas saw an uptick in multifamily permitting from May 2013 to May 2014, according to U.S. Census Bureau research. Yet permitting dropped in both areas from May 2014 to May 2015.

“The deliveries we’re seeing now are those that were mostly permitted in early to-mid-2013,” said McCleskey, noting that not everything permitted for construction is built.

“But an increase in permitting means that developers are comfortable enough with the market to take their projects through the process,” McCleskey said.