The Fort Worth housing market recorded some good news in March with a slight uptick in the median home sales price from February as well as a modest increase in the number of houses sold during the month.

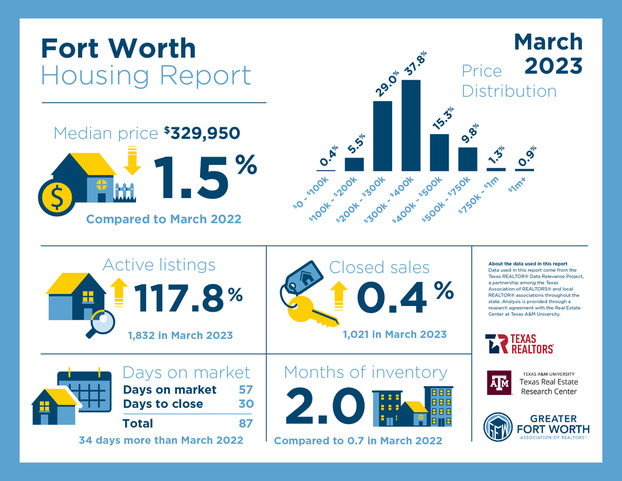

The median sales price of a home in Fort Worth during March was $329,950, up from the median sales price of $325,000 for February but still a decline of 1.5 percent from the March 2022 median price of $335,000.

The number of houses grew to 1,021, an increase of 0.4 percent from a year ago but significant because it represents the first increase in year-over-year closed sales in the past 12 months.

Inventory continued to fluctuate slightly, edging back up to 2.0 months in March after sliding down to 1.9 months in February from 2.1 months in January.

Inventory remained below the Texas Real Estate Research Center at Texas A&M University’s benchmark of 6.5 months of inventory as a balanced real estate market.

Across Tarrant County, the median home sales price of $ 340,000 was 2.9 percent below the March 2022 median sales price of $350,000. The number of closed sales declined by 4.4 percent.

However, fast-growing Parker and Johnson counties recorded increases in home sales prices in March compared with a year ago. In Parker County the median sales price in March was $462,000, an increase of 2.7 percent from the previous year. Johnson County’s median sales price of $339,995 was a year-over-year increase of 1.3 percent.

Inventory during March was 1.8 months across Tarrant County, 3.1 months in Johnson County and 3.6 months in Parker County.

The level of inventory in Fort Worth and across the other three areas was significantly higher than a year ago when inventory hovered at about one month or below due to low interest rates and a strong sellers’ market.

Active listings were dramatically higher in March than a year ago across all four areas, ranging from a 109.9 percent increase in Tarrant County to a 218.9 percent increase in Parker County.

Although market conditions are more favorable for buyers, interest rates are still keeping many on the sidelines.

“Active listings are more than double what they were at this time last year, but the mortgage rates are still a factor,” Bart Calahan, president of the Greater Fort Worth Association of Realtors, said in a statement.

“Even a small fluctuation can have a big impact on a monthly mortgage payment,” he stated. “Hopefully the rates will continue to fall or at least stabilize, so buyers can get more comfortable with what they are able to afford.”

Heading into the spring buying season, industry leaders are optimistic that the housing market will improve with higher interest rates and limited inventory due to homeowners with locked-in low interest rates opting to stay put.

“After nearly a year, the housing sector’s contraction is coming to an end,” Lawrence Yun, chief economist for the National Association of Realtors, said in a statement. “Existing-home sales, pending contracts, and new-home construction pending contracts have turned the corner and climbed for the past three months.”

Interest rates on a 30-year, fixed-rate mortgage rose slightly to 6.43 percent on Thursday (April 27), up from 6.39 percent a week ago, according to Freddie Mac. A year ago, the 30-year, fixed-rate mortgage averaged 5.10 percent.

“The 30-year fixed-rate mortgage increased modestly for the second straight week, but with the rate of inflation decelerating rates should gently decline over the course of 2023,” Sam Khater, Freddie Mac’s chief economist, said in a statement.

“Incoming data suggest the housing market has stabilized from a sales and house price perspective,” Khater stated. “The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.”