With the busy home-buying season underway, prospective buyers may be disappointed that there isn’t as much selection as they had hoped to find.

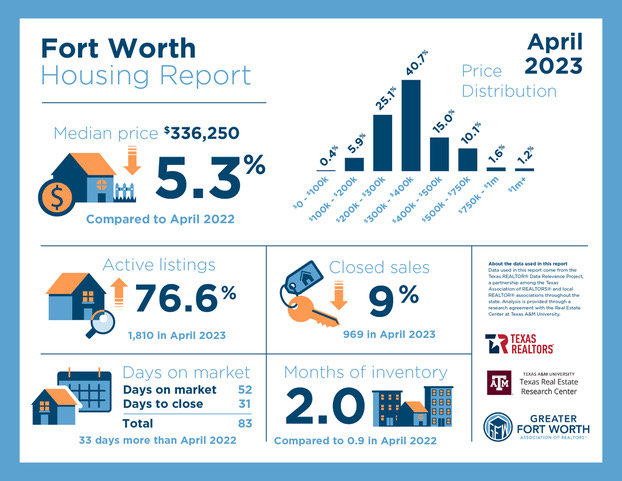

During April, inventory on the market in Fort Worth held steady with March at two months. Across Tarrant County, inventory was steady at only 1.8 months during April.

Although those levels were about double the available inventory a year ago, the April levels remained below the Texas Real Estate Research Center at Texas A&M University’s balanced real estate market benchmark of 6.5 months of inventory.

Meanwhile, the median sales price of a home in Fort Worth slid 5.3 percent during April to $336,250 from $355,000 a year ago. Yet, the April median price was an increase from the $329,950 price recorded in March this year.

Across Tarrant County, the median home sales price of $349,925 was higher than the median sales price of $340,000 in March but 4.4 percent below the median home sales price of $366,500 a year ago.

Fast-growing Johnson County recorded a median home price of $350,000 during April, a 3 percent increase compared to the April 2022 median sales price of $336,000. During March this year, the median selling price was $339,995.

Parker County’s median sales price of $474,000 in April was 1.3 percent below the April 2022 median price of $481,800. The county’s March median sales price was $462,000.

During April, Johnson County had inventory of 2.9 months compared to 1.4 months a year ago and Parker County had 3.8 months compared to 1.4 months in April 2022.

“The key difference affecting our market from spring of 2022 to spring of 2023 is mortgage rates,” Bart Calahan, president of the Greater Fort Worth Association of Realtors, said in a statement “Even though we have more inventory, the market is holding very steady compared to last year’s frenzy due to the impact that higher mortgage rates have on affordability.”

National Association of Realtors Chief Economist Lawrence Yun recently reported that new home sales are back to pre-pandemic levels but existing-home sales are at historical lows.

Across the county, housing inventory is down 40 percent compared to the first quarter of 2019. The housing market is being held back by the lack of housing inventory, a problem that existed before the pandemic.

“Due to the intense housing inventory shortage, multiple offers are returning, especially on affordable homes,” Yun said in a statement. “Price declines could be short-lived.”

Many would-be sellers are choosing not to sell, even though they would like to purchase a different home, according to a report from Realtor.com. More than three-quarters of potential sellers feel “locked in” to low mortgage rates, which they are reluctant to trade for higher rates.

Interest rates on a 30-year, fixed rate mortgage rose to 6.57 percent on Thursday (today), up from 6.39 percent a week ago. A year ago, the 30-year, fixed-rate mortgage averaged 5.10 percent, according to Freddie Mac.

“The U.S. economy is showing continued resilience which, combined with debt ceiling concerns, led to higher mortgage rates this week,” Freddie Mac Chief Economist Sam Khater said in a statement.

“Dampened affordability remains an issue for interested homebuyers and homeowners seem unwilling to lose their low rate and put their home on the market,” Khater stated. “If this predicament continues to limit supply, it could open up an opportunity for builders to help address the country’s housing shortage.”