This time of year, shoppers are discovering that many of their favorite stores are shutting doors. Walmart has said that it will close 154 U.S. stores this year. Macy’s is in the process of axing 40 locations. By June, department store Kohl’s will shutter 18 stores.

Some of this is surely cyclical, as retailers routinely look to the beginning of the calendar year as a moment to prune underperforming outlets. But this year, it is hard not to see deeper meaning in the wave of closures: The retail industry recorded a disappointing holiday shopping season, delivering 3 percent sales growth, below the 3.7 percent increase it had expected. Meanwhile, shopping dollars continue to march online, and young, affluent consumers are moving back into big cities instead of taking up in America’s mall-dotted suburbs. That confluence of factors poses a tough question: Do some of the biggest names in retail simply have too many stores?

In industry jargon, this is called being “overstored,” and it is a position that more and more retailers – especially the large ones – are likely to find themselves in as shopping and demographic patterns change.

The retail landscape is changing as individual retailers rethink their store portfolios. The pullback has many shopping center owners looking more broadly for tenants, targeting such “lifestyle businesses” as restaurants, health clubs and movie theaters.

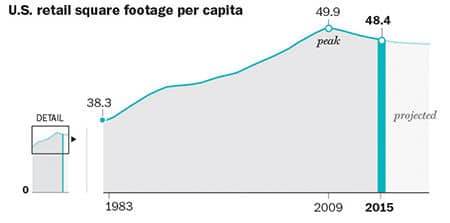

This is a relatively recent phenomena. Retail square footage per capita in the United States grew steadily for more than 20 years, according to data from real estate research firm CoStar Group. But around 2009, coinciding with the recession, the tide turned.

New shopping center square footage took a nosedive, and even now as the economy recovers, new store space is not being added in nearly the volumes that it was for much of the 20 preceding years.

For the first time in 35 years, “population growth is actually faster than new construction,” said Suzanne Mulvee, director of research at CoStar.

Simply put, there is less shopping space per person today, and a return to an especially aggressive pace of building is not expected. That would seem like an acknowledgment by retailers and mall developers that a course correction is necessary to adapt to today’s shopping environment.

Indeed, it seems that the rise of online shopping has fundamentally changed what it means for a retailer to give up a store. Now, such moves are often cast as playing offense rather than defense, a proactive choice to move toward a more digital-centric future instead of a worrisome retreat.

“There’s retailers who decide not to stay open, and there’s retailers who decide to close. And that’s different,” said Ken Nisch, chairman at JGA, a consultancy that works on retail store design.

Walmart, for example, announced 269 global store closures earlier this year. It was highly unusual for world’s largest retailer to close such a big batch of stores at once, and last year was the first time in at least 45 years that it saw its revenue shrink. But look at the closures this way: Walmart also plans to open 300 new stores this year, including between 155 and 165 in the United States. That means many of the shuttered stores here are effectively being replaced by ones that the company thinks are better-suited to reach its customers. And it is making e-commerce a major priority, pouring billions of dollars into boosting its online operation.

But it is fair to interpret differently the store closures at the likes of Jos. A. Bank and Sports Authority. Jos. A. Bank is closing up to 90 stores as its sales plummet. New management is trying to abandon the “three for one” promotions, but it hasn’t yet figured out how to get consumers excited about a new approach to deals.

Sports Authority, meanwhile, somehow managed to flounder at a moment when fashionable athleisure gear is flying high and when some of its core brand offerings, such as Nike and Under Armour, are seeing blockbuster sales results. So its decision to close 140 stores and file for bankruptcy might reflect deeper, unique problems more than it reflects macro shifts in retailing and culture.

In other words, all “overstored” situations are not created equal.

Just how small could some of the biggest chains in retail get? Nisch said that specialty chains, at least, will perhaps find around 250 to 300 stores to be the sweet spot. He points to Williams-Sonoma as a blueprint of where more legacy brick-and-mortar retailers might be headed. Williams-Sonoma has 239 stores that are largely located in high-performing malls, and it is already drawing more than 50 percent of its sales from e-commerce.

Melina Cordero, director of retail research at CBRE, said some chains are asking themselves right now whether their space conundrums could be solved not by shrinking the total number of stores, but by reducing the size of the stores. Indeed, there are examples at the mall of companies that are giving this a try: Aerie, the American Eagle Outfitters-owned lingerie chain, has been testing a smaller-format version of its stores and has said it sees a 60 percent improvement in productivity in those shops. Burlington Coat Factory also has said it is going to continue to go smaller with its stores. Its existing small-format stores are 22 percent more productive than the rest of the chain.

“What we’re learning from that is we can have the entire Burlington assortment in a smaller box,” said Thomas Kingsbury, the chief executive of parent company Burlington Stores, on a conference call with investors in November.

Still more retailers are simply repurposing some of their real estate: Staples, for example, said it is teaming up with a company called Workbar to add co-working spaces to some of its stores. Sears has been leasing some of its store space to the likes of Nordstrom Rack and Dick’s Sporting Goods.

As stores adjust their fleets, Nisch said, certain types of malls are likely to impacted more than others. Major malls in affluent areas should be able to hang onto their tenants, he said, because they are prime destinations for customers who like the social experience of going shopping, the ones who want to gossip with a pal in the dressing room while they try on jeans.

But, it’s the smaller centers – the ones built for convenient fill-in trips – that probably will suffer. Those are the dollars that are likely to move online.

There are other ways, too, that pullbacks for big retailers appear to be playing out unevenly. CoStar researchers found that retailers are disproportionately leaving poorer, rural neighborhoods. CoStar measured the number of households in a given area and the median household income to determine what it calls “buying power.” The result: Vacancy rates are drastically higher in areas with lower buying power.

Still, while individual retailers may be overstored, some experts make the case that the retail real estate market overall doesn’t suffer a glut of space. Millions of square feet of retailing space are projected to be added this year, and commercial real estate experts say there is a healthy pipeline of interested tenants to fill it.

Cordero of CBRE says that there is a bumper crop of European retailers looking to carve out a presence here, including U.K.-based fast-fashion chain Primark and German discount grocer Lidl. And, players already established stateside, such as H&M, are still looking to expand.