Home sales prices continued to to slide in the greater Fort Worth area in September as rising interest rates were pricing some prospective buyers out of the market.

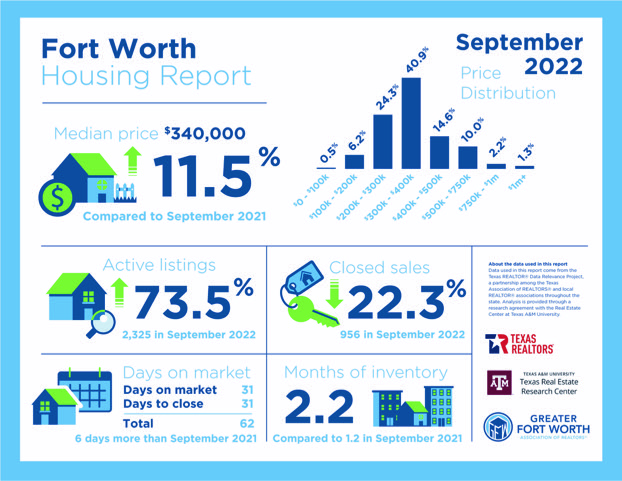

The median price in for a home sold in Fort Worth during September dropped to $340,000, down from August’s median sales price of $350,000.

Nevertheless, the median sales price last month was still an 11.5 percent increase compared to September 2021 and a 36 percent increase compared to September 2020, according to data from the Greater Fort Worth Association of Realtors, the Real Estate Research Center at Texas A&M University and Texas Realtors.

The same sales trends were evident across Tarrant County and in Johnson and Parker counties.

Median sales prices in Tarrant County declined from $365,000 in August to $353,000 in September, a 13.1 percent increase compared to 2021.

Johnson County’s median sales price fell from $350,000 in August to $332,230 in September, which was an increase of 10.3 percent compared to September 2021. And Parker County’s median home sales price dropped from $452,500 in August to $421,500 in September, which was still an increase of 8.1 percent over September 2021 median sales prices.

As prices have fallen, inventory has increased but not as rapidly as Realtors and market experts had hoped. Inventory has inched up above two months supply, compared to earlier months this year when inventory was below a one-month supply. A balanced supply of inventory is 6.5 months.

“There’s still a fairly low inventory because sellers are hesitant to list,” Shannon Ashkinos, 2022 president of the Greater Fort Worth Association of REALTORS, said in a statement.

“Although prices are better now for buyers and more negotiation options are on the table, the rapid rise in interest rates has been a powerful damper on the market,” Ashkinos stated.

Freddie Mac reported the average interest rate on a 30-year mortgage was 6.94 as of Oct. 20, more than double the rate of a year ago and adding hundreds of dollars a month in financing costs for buyers.

“We continue to see a tale of two economies in the data,” Sam Khater, chief economist at Freddie Mac, said in a statement. “Strong job and wage growth are keeping consumers’ balance sheets positive, while lingering inflation, recession fears and housing affordability are driving house demand down precipitously.

“The next several months will undoubtedly be important for the economy and the housing market,” Khater said.

During September, sales closed on 956 homes, down 22.3 percent from a year ago. Across Tarrant County, 2,127 homes closed in September, down 21.4 percent from September 2021.

At the same time, sales of 274 homes closed in Johnson County and 283 homes closed in Parker County during September. The number of closings declined 8.3 percent in Johnson County and 7.2 percent in Parker County compared to a year ago.